Summary

Effective risk management solutions become absolutely crucial when financial markets embrace distributed technology and decentralized financing (DeFi). This study offers a thorough survey and comparative analysis of the integration of artificial intelligence (AI) in risk management for distributed arbitrage systems. We examine several modern caching techniques namely in memory caching, distributed caching, and proxy caching and their functions in enhancing performance in decentralized settings. Through literature review we examine the utilization of AI techniques for alleviating risks related to market volatility, liquidity challenges, operational failures, regulatory compliance, and security threats. This comparison research evaluates various case studies from prominent DeFi technologies, emphasizing critical performance metrics like latency reduction, load balancing, and system resilience. Additionally, we examine the problems and trade offs associated with these technologies, emphasizing their effects on consistency, scalability, and fault tolerance. By meticulously analyzing real world applications, specifically centering on the Aave platform as our principal case study, we illustrate how the purposeful amalgamation of AI with contemporary caching methodologies has revolutionized risk management in distributed arbitrage systems.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a thorough survey and comparative analysis, examining various case studies from prominent DeFi technologies, and focusing on the Aave platform as the principal case study. It analyzes real-world applications, emphasizing critical performance metrics like latency reduction, load balancing, and system resilience.

Key Results

- AI-driven risk management revolutionizes distributed arbitrage systems by integrating contemporary caching methodologies.

- AI techniques effectively address risks related to market volatility, liquidity challenges, operational failures, regulatory compliance, and security threats.

- The study identifies core risk mitigation strategies, including diversification, automated trading algorithms, insurance and hedging programs, real-time monitoring systems, regulatory compliance frameworks, and incident response planning.

Significance

This research is crucial as it offers a comprehensive framework for managing risks in distributed arbitrage systems, which is essential with the rise of decentralized finance. It provides valuable insights into the application of AI in enhancing performance, consistency, scalability, and fault tolerance.

Technical Contribution

The paper presents an AI-driven risk management system architecture for distributed arbitrage systems, incorporating a four-layer structure for data input, AI processing, risk management, and monitoring.

Novelty

This work stands out by integrating AI with modern caching techniques and providing a detailed case study on the Aave platform, demonstrating the practical application and benefits of AI in risk management within DeFi.

Limitations

- AI models may suffer from overfitting or fail to capture subtle market changes, leading to improper risk assessments and trading decisions.

- High computational costs and time requirements associated with AI algorithms may hinder real-time decision-making, particularly in high-frequency trading environments.

Future Work

- Further research should focus on developing overall risk metrics tailored to DeFi's unique characteristics.

- Enhancing explainability in AI decision-making processes to build stakeholder confidence is another area for future exploration.

Paper Details

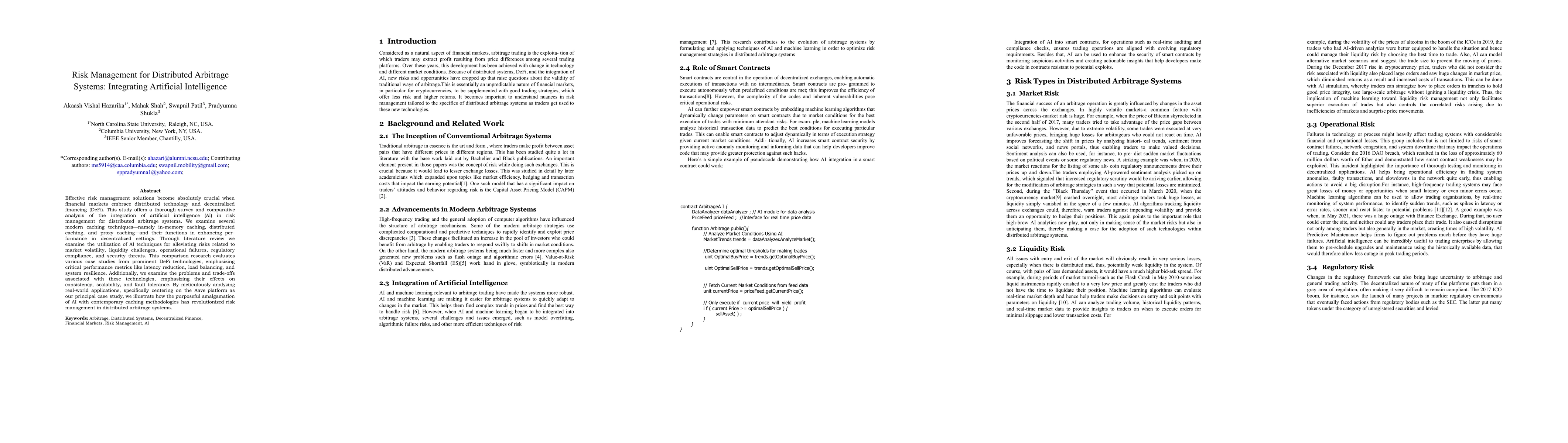

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Cybersecurity Risk Analysis Framework for Systems with Artificial Intelligence Components

David Arroyo, David Rios Insua, Jose Manuel Camacho et al.

Artificial Intelligence (AI)-Centric Management of Resources in Modern Distributed Computing Systems

No citations found for this paper.

Comments (0)