Authors

Summary

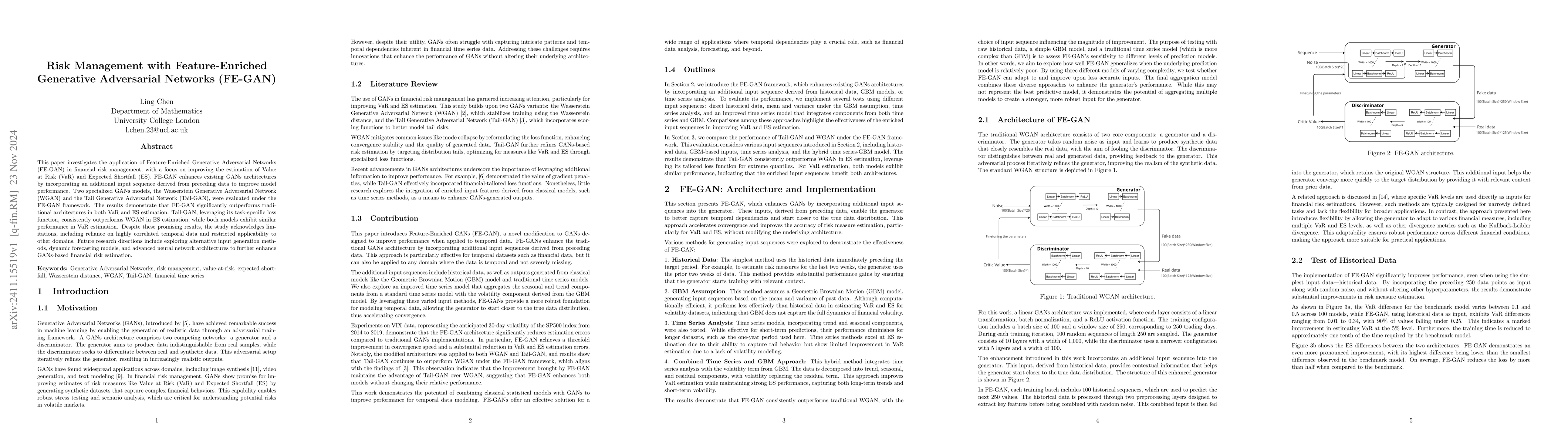

This paper investigates the application of Feature-Enriched Generative Adversarial Networks (FE-GAN) in financial risk management, with a focus on improving the estimation of Value at Risk (VaR) and Expected Shortfall (ES). FE-GAN enhances existing GANs architectures by incorporating an additional input sequence derived from preceding data to improve model performance. Two specialized GANs models, the Wasserstein Generative Adversarial Network (WGAN) and the Tail Generative Adversarial Network (Tail-GAN), were evaluated under the FE-GAN framework. The results demonstrate that FE-GAN significantly outperforms traditional architectures in both VaR and ES estimation. Tail-GAN, leveraging its task-specific loss function, consistently outperforms WGAN in ES estimation, while both models exhibit similar performance in VaR estimation. Despite these promising results, the study acknowledges limitations, including reliance on highly correlated temporal data and restricted applicability to other domains. Future research directions include exploring alternative input generation methods, dynamic forecasting models, and advanced neural network architectures to further enhance GANs-based financial risk estimation.

AI Key Findings

Generated Sep 04, 2025

Methodology

This study applied FE-GAN to financial risk management, enhancing existing GAN architectures with additional input sequences.

Key Results

- FE-GAN significantly outperformed traditional WGAN in both VaR and ES estimation.

- Using historical data or mean-variance inputs derived under the GBM model, FE-GAN achieved notable reductions in VaR estimation errors.

- The incorporation of time series components further improved ES estimation, reflecting the complementarity of trend and seasonality analysis alongside volatility modeling.

Significance

This research contributes to financial risk management by providing a flexible and effective tool for estimating VaR, ES, and potentially other risk measures.

Technical Contribution

FE-GAN's ability to leverage additional input sequences enhances its performance in financial risk estimation.

Novelty

The application of FE-GAN to financial risk management and the incorporation of time series components make this work novel and different from existing research.

Limitations

- The reliance on highly correlated temporal data restricts the broader applicability of FE-GAN to other domains.

- The study focused exclusively on VaR estimation, leaving the performance of FE-GAN on other risk measures unexplored.

Future Work

- Experimenting with alternative neural network architectures to further enhance performance.

- Testing the framework on diverse datasets and risk measures.

- Incorporating advanced temporal modeling techniques, such as LSTM networks or attention-based mechanisms.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Risk Identification in Supply Chains Using Generative Adversarial Networks

Yu Cheng, Qianying Liu, Xinshi Li et al.

No citations found for this paper.

Comments (0)