Summary

We develop quantile regression models in order to derive risk margin and to evaluate capital in non-life insurance applications. By utilizing the entire range of conditional quantile functions, especially higher quantile levels, we detail how quantile regression is capable of providing an accurate estimation of risk margin and an overview of implied capital based on the historical volatility of a general insurers loss portfolio. Two modelling frameworks are considered based around parametric and nonparametric quantile regression models which we develop specifically in this insurance setting. In the parametric quantile regression framework, several models including the flexible generalized beta distribution family, asymmetric Laplace (AL) distribution and power Pareto distribution are considered under a Bayesian regression framework. The Bayesian posterior quantile regression models in each case are studied via Markov chain Monte Carlo (MCMC) sampling strategies. In the nonparametric quantile regression framework, that we contrast to the parametric Bayesian models, we adopted an AL distribution as a proxy and together with the parametric AL model, we expressed the solution as a scale mixture of uniform distributions to facilitate implementation. The models are extended to adopt dynamic mean, variance and skewness and applied to analyze two real loss reserve data sets to perform inference and discuss interesting features of quantile regression for risk margin calculations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

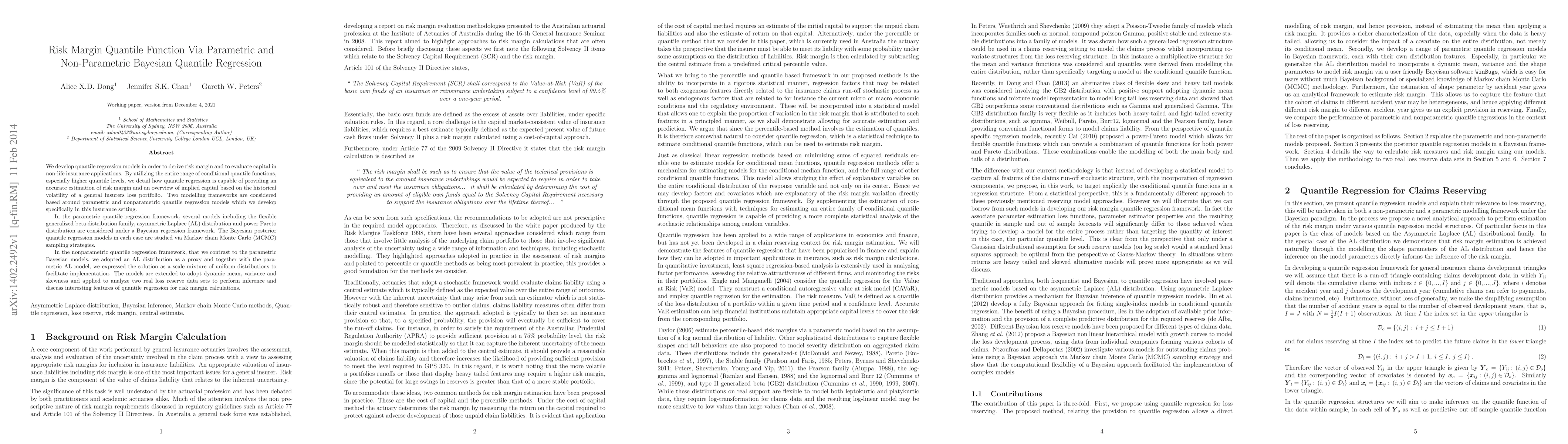

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)