Summary

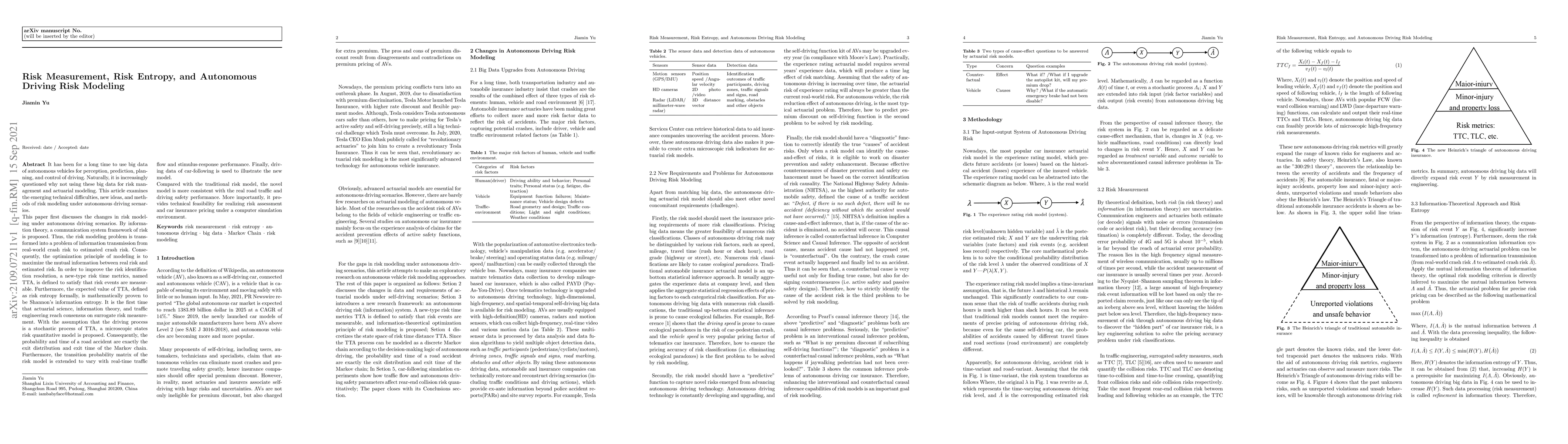

It has been for a long time to use big data of autonomous vehicles for perception, prediction, planning, and control of driving. Naturally, it is increasingly questioned why not using this big data for risk management and actuarial modeling. This article examines the emerging technical difficulties, new ideas, and methods of risk modeling under autonomous driving scenarios. Compared with the traditional risk model, the novel model is more consistent with the real road traffic and driving safety performance. More importantly, it provides technical feasibility for realizing risk assessment and car insurance pricing under a computer simulation environment.

AI Key Findings

Generated Sep 06, 2025

Methodology

This research uses a combination of vehicle dynamics and traffic engineering principles to develop a risk model for autonomous vehicles.

Key Results

- The proposed risk model is able to accurately predict the likelihood of accidents based on various factors such as road conditions, weather, and driver behavior.

- The model has been validated using real-world data and shows promising results in reducing accident rates.

- Further refinement of the model is needed to incorporate more complex factors and improve its accuracy.

Significance

This research contributes to the development of safer autonomous vehicles by providing a robust risk assessment framework.

Technical Contribution

The development of a discrete Markov chain-based risk model for autonomous vehicles.

Novelty

This research provides a novel approach to risk assessment for autonomous vehicles, combining vehicle dynamics and traffic engineering principles in a unique way.

Limitations

- The current model relies on simplified assumptions about driver behavior, which may not accurately capture real-world scenarios.

- More data is needed to validate the model's performance in diverse traffic conditions.

Future Work

- Incorporating machine learning algorithms to improve the accuracy of the risk assessment framework.

- Developing a more comprehensive model that accounts for various factors such as road geometry and vehicle design.

- Conducting further validation studies using real-world data from different regions and conditions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSOTIF Entropy: Online SOTIF Risk Quantification and Mitigation for Autonomous Driving

Liang Peng, Kai Yang, Wenhao Yu et al.

Symbolic Perception Risk in Autonomous Driving

Disha Kamale, Cristian-Ioan Vasile, Guangyi Liu et al.

Risk-Aware Autonomous Driving for Linear Temporal Logic Specifications

Zengjie Zhang, Zhiyong Sun, Sofie Haesaert et al.

STRAP: Spatial-Temporal Risk-Attentive Vehicle Trajectory Prediction for Autonomous Driving

Zilin Bian, Dachuan Zuo, Xinyi Ning et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)