Summary

The paper analyzes risk assessment for cash flows in continuous time using the notion of convex risk measures for processes. By combining a decomposition result for optional measures, and a dual representation of a convex risk measure for bounded \cd processes, we show that this framework provides a systematic approach to the both issues of model ambiguity, and uncertainty about the time value of money. We also establish a link between risk measures for processes and BSDEs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

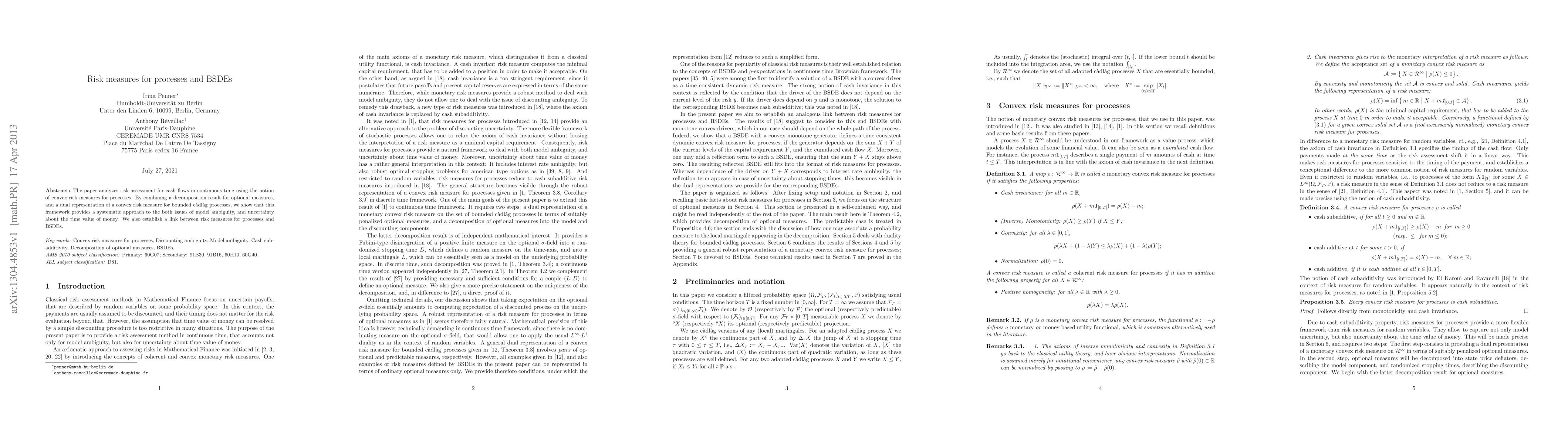

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Return and Star-Shaped Risk Measures via BSDEs

Emanuela Rosazza Gianin, Roger J. A. Laeven, Marco Zullino

Capital allocation for cash-subadditive risk measures: from BSDEs to BSVIEs

Emanuela Rosazza Gianin, Marco Zullino

Fully-dynamic risk measures: horizon risk, time-consistency, and relations with BSDEs and BSVIEs

Giulia Di Nunno, Emanuela Rosazza Gianin

| Title | Authors | Year | Actions |

|---|

Comments (0)