Summary

It has been decades since the academic world of ruin theory defined the insolvency of an insurance company as the time when its surplus falls below zero. This simplification, however, needs careful adaptions to imitate the real-world liquidation process. Inspired by Broadie et al. (2007) and Li et al. (2020), this paper uses a three-barrier model to describe the financial stress towards bankruptcy of an insurance company. The financial status of the insurer is divided into solvent, insolvent and liquidated three states, where the insurer's surplus process at the state of solvent and insolvent is modelled by two spectrally negative L\'{e}vy processes, which have been taken as good candidates to model insurance risks. We provide a rigorous definition of the time of liquidation ruin in this three-barrier model. By adopting the techniques of excursions in the fluctuation theory, we study the joint distribution of the time of liquidation, the surplus at liquidation and the historical high of the surplus until liquidation, which generalizes the known results on the classical expected discounted penalty function in Gerber and Shiu (1998). The results have semi-explicit expressions in terms of the scale functions and the L\'{e}vy triplets associated with the two underlying L\'{e}vy processes. The special case when the two underlying L\'{e}vy processes coincide with each other is also studied, where our results are expressed compactly via only the scale functions. The corresponding results have good consistency with the existing literatures on Parisian ruin with (or without) a lower barrier in Landriault et al. (2014), Baurdoux et al. (2016) and Frostig and Keren-Pinhasik (2019). Besides, numerical examples are provided to illustrate the underlying features of liquidation ruin.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

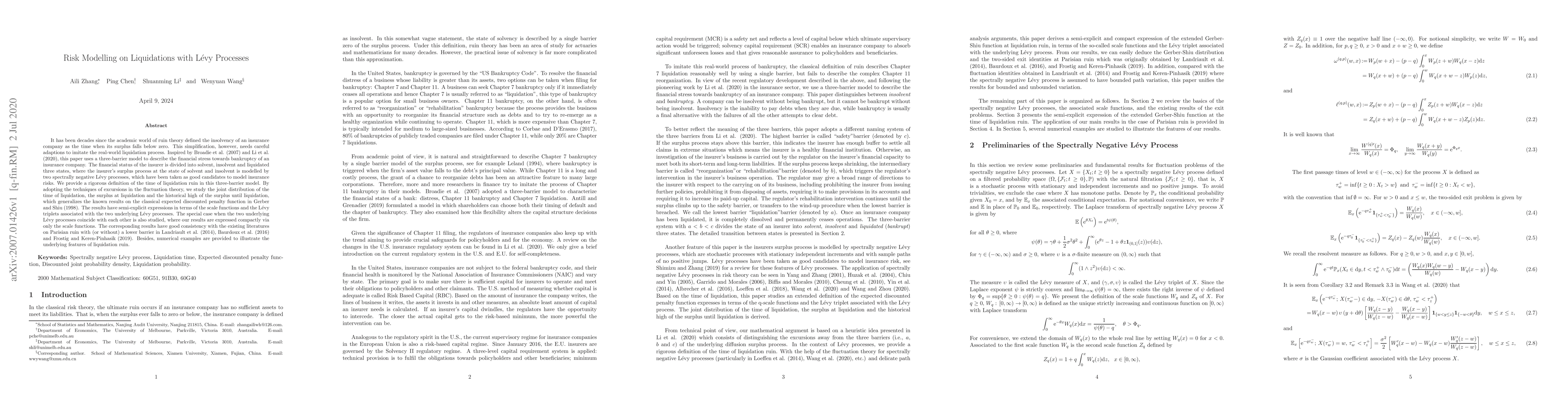

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)