Authors

Summary

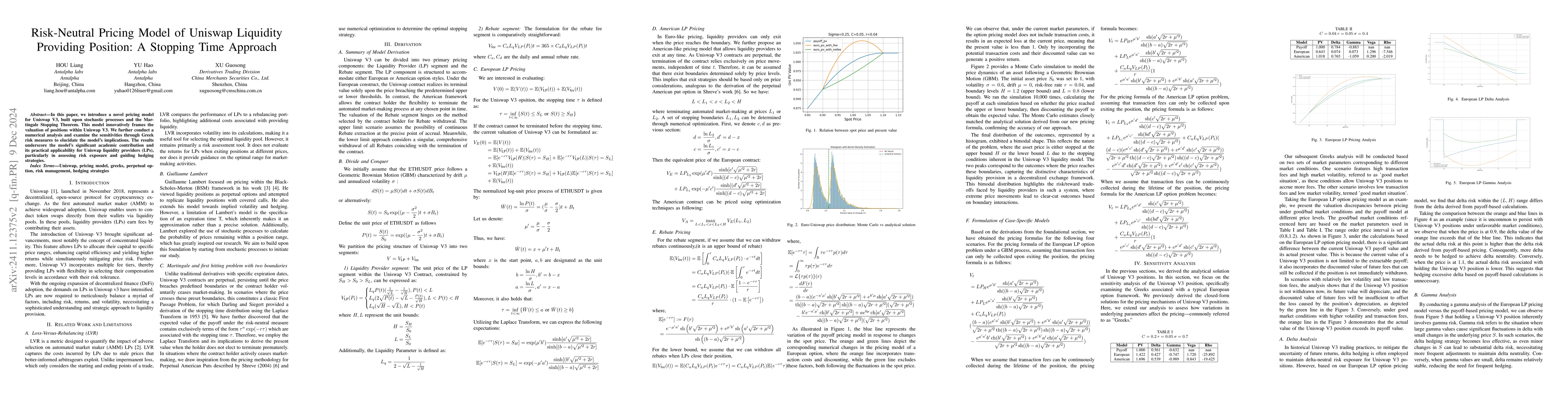

In this paper, we introduce a novel pricing model for Uniswap V3, built upon stochastic processes and the Martingale Stopping Theorem. This model innovatively frames the valuation of positions within Uniswap V3. We further conduct a numerical analysis and examine the sensitivities through Greek risk measures to elucidate the model's implications. The results underscore the model's significant academic contribution and its practical applicability for Uniswap liquidity providers, particularly in assessing risk exposure and guiding hedging strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Liquidity Providing via Margin Liquidity

Juntae Kim, Yeonwoo Jeong, Chanyoung Jeoung et al.

Uniswap Liquidity Provision: An Online Learning Approach

Yishay Mansour, Yogev Bar-On

Risks and Returns of Uniswap V3 Liquidity Providers

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

No citations found for this paper.

Comments (0)