Summary

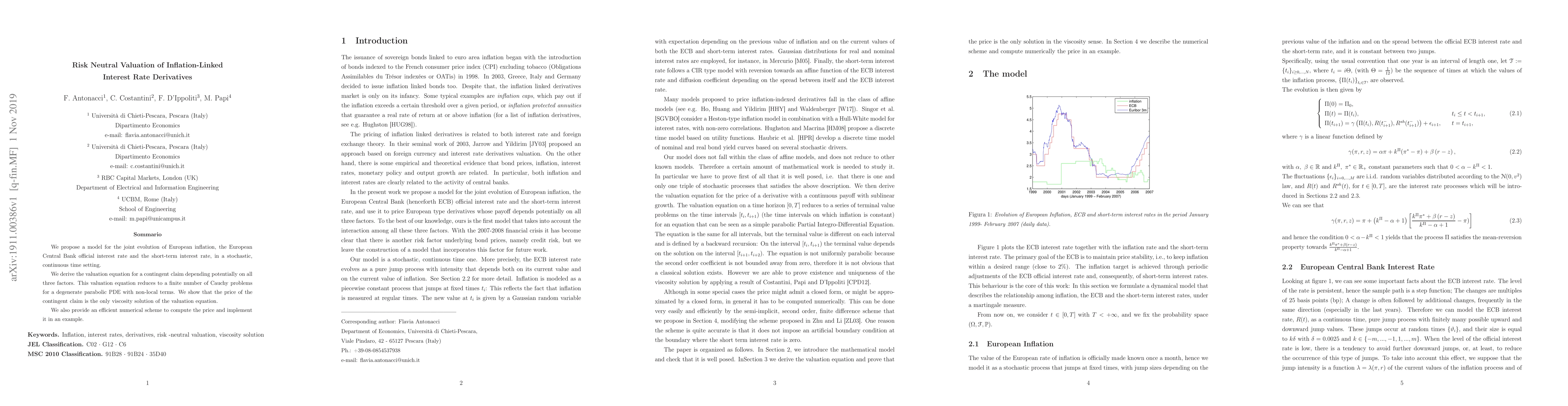

We propose a model for the joint evolution of European inflation, the European Central Bank official interest rate and the short-term interest rate, in a stochastic, continuous time setting. We derive the valuation equation for a contingent claim depending potentially on all three factors. This valuation equation reduces to a finite number of Cauchy problems for a degenerate parabolic PDE with non-local terms. We show that the price of the contingent claim is the only viscosity solution of the valuation equation. We also provide an efficient numerical scheme to compute the price and implement it in an example.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)