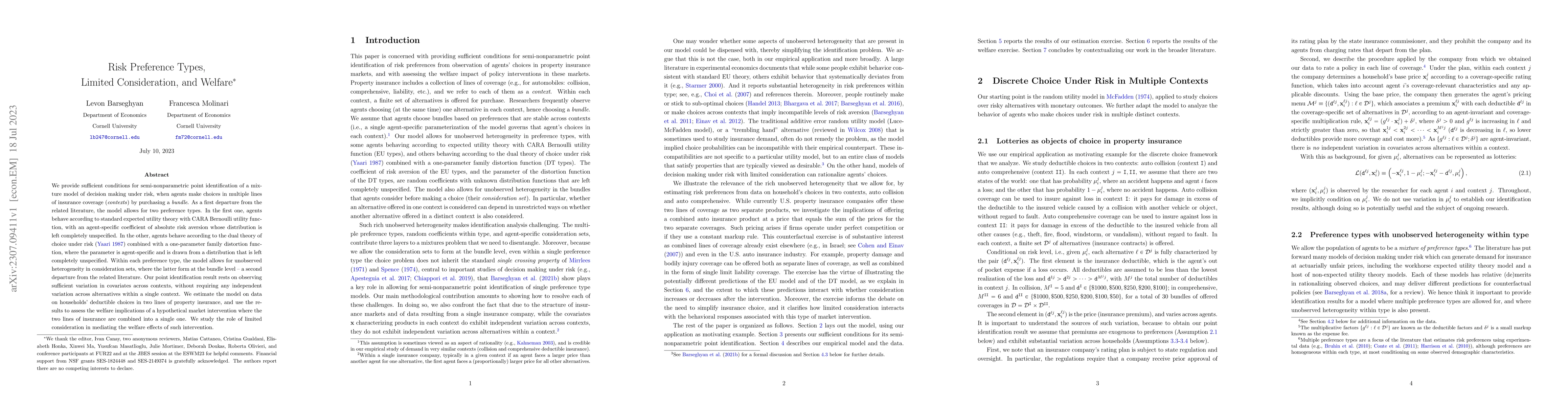

Authors

Summary

We provide sufficient conditions for semi-nonparametric point identification of a mixture model of decision making under risk, when agents make choices in multiple lines of insurance coverage (contexts) by purchasing a bundle. As a first departure from the related literature, the model allows for two preference types. In the first one, agents behave according to standard expected utility theory with CARA Bernoulli utility function, with an agent-specific coefficient of absolute risk aversion whose distribution is left completely unspecified. In the other, agents behave according to the dual theory of choice under risk(Yaari, 1987) combined with a one-parameter family distortion function, where the parameter is agent-specific and is drawn from a distribution that is left completely unspecified. Within each preference type, the model allows for unobserved heterogeneity in consideration sets, where the latter form at the bundle level -- a second departure from the related literature. Our point identification result rests on observing sufficient variation in covariates across contexts, without requiring any independent variation across alternatives within a single context. We estimate the model on data on households' deductible choices in two lines of property insurance, and use the results to assess the welfare implications of a hypothetical market intervention where the two lines of insurance are combined into a single one. We study the role of limited consideration in mediating the welfare effects of such intervention.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandom Utility and Limited Consideration

Nail Kashaev, Victor H. Aguiar, Jeongbin Kim et al.

Revealed Preference Analysis Under Limited Attention

Mikhail Freer, Hassan Nosratabadi

| Title | Authors | Year | Actions |

|---|

Comments (0)