Summary

An important but understudied question in economics is how people choose when facing uncertainty in the timing of events. Here we study preferences over time lotteries, in which the payment amount is certain but the payment time is uncertain. Expected discounted utility theory (EDUT) predicts decision makers to be risk-seeking over time lotteries. We explore a normative model of growth-optimality, in which decision makers maximise the long-term growth rate of their wealth. Revisiting experimental evidence on time lotteries, we find that growth-optimality accords better with the evidence than EDUT. We outline future experiments to scrutinise further the plausibility of growth-optimality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

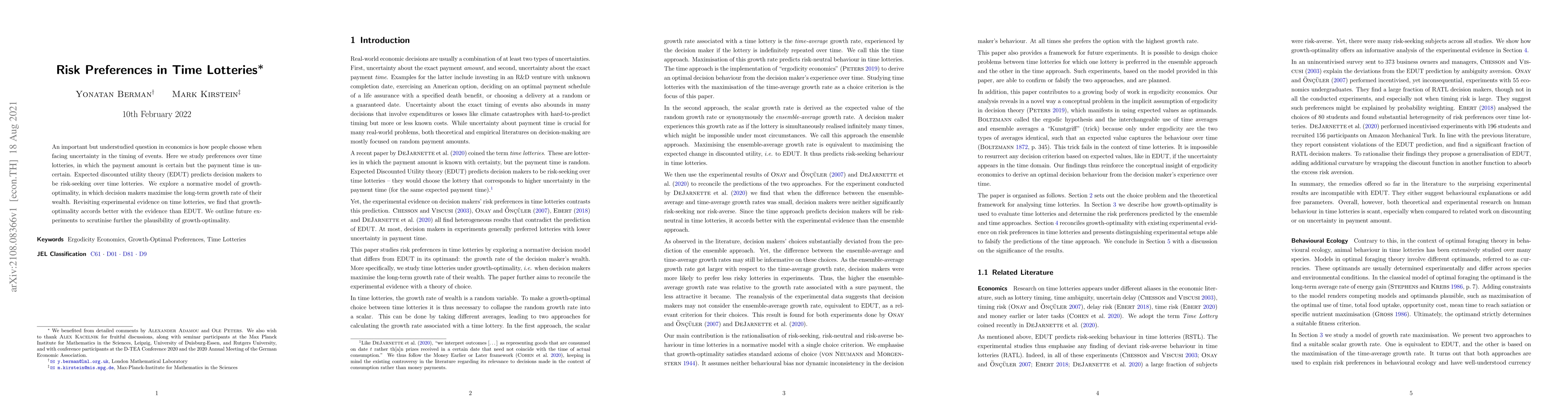

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)