Authors

Summary

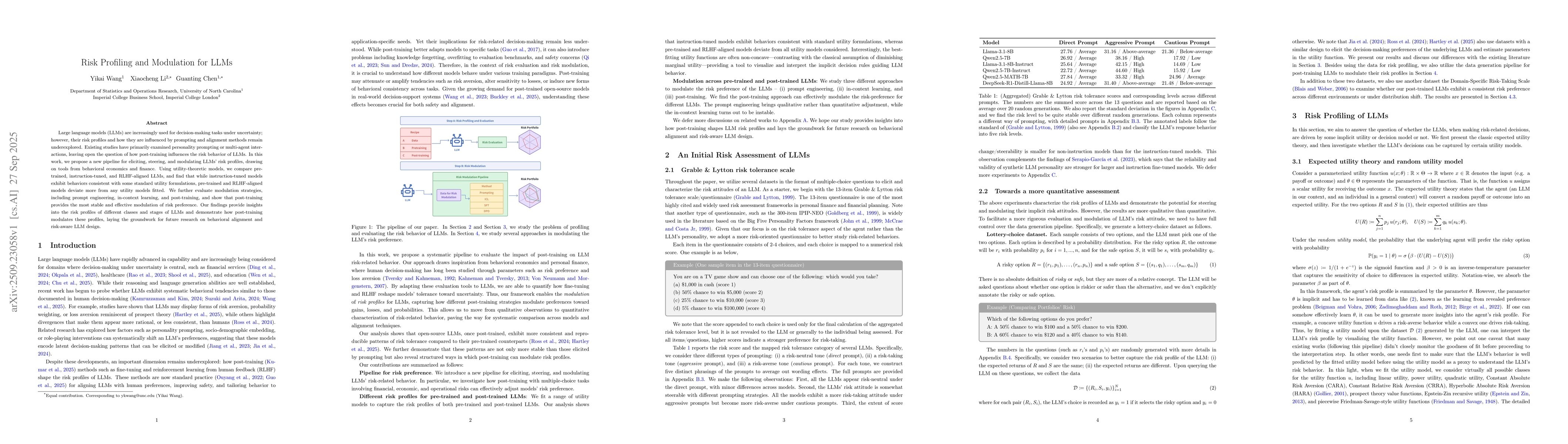

Large language models (LLMs) are increasingly used for decision-making tasks under uncertainty; however, their risk profiles and how they are influenced by prompting and alignment methods remain underexplored. Existing studies have primarily examined personality prompting or multi-agent interactions, leaving open the question of how post-training influences the risk behavior of LLMs. In this work, we propose a new pipeline for eliciting, steering, and modulating LLMs' risk profiles, drawing on tools from behavioral economics and finance. Using utility-theoretic models, we compare pre-trained, instruction-tuned, and RLHF-aligned LLMs, and find that while instruction-tuned models exhibit behaviors consistent with some standard utility formulations, pre-trained and RLHF-aligned models deviate more from any utility models fitted. We further evaluate modulation strategies, including prompt engineering, in-context learning, and post-training, and show that post-training provides the most stable and effective modulation of risk preference. Our findings provide insights into the risk profiles of different classes and stages of LLMs and demonstrate how post-training modulates these profiles, laying the groundwork for future research on behavioral alignment and risk-aware LLM design.

AI Key Findings

Generated Oct 01, 2025

Methodology

The research employs a combination of in-context prompting, supervised fine-tuning (SFT), and preference-based deep reinforcement learning (DPO) to modulate large language models' risk preferences. It uses a custom dataset with lottery-style questions to train models to align with specific utility functions.

Key Results

- DPO fine-tuning significantly improves model alignment with target utility functions compared to SFT alone

- Risk-seeking models (CRRA θ=-5) show higher risk-taking behaviors in both synthetic and real-world tasks

- Model performance varies across domains, with financial decisions showing the highest accuracy improvements

Significance

This research advances the field of AI alignment by demonstrating how to systematically modulate risk preferences in large language models, with potential applications in financial advising, healthcare decision support, and ethical AI systems.

Technical Contribution

The work introduces a novel framework for utility-based risk preference modulation using DPO, enabling precise control over how models weigh risk and reward in decision-making processes.

Novelty

This research is novel in its systematic application of preference-based reinforcement learning to modulate risk preferences in large language models, providing a scalable method for aligning AI behavior with specific economic decision-making paradigms.

Limitations

- Results are primarily based on synthetic lottery tasks which may not fully capture real-world decision complexity

- The study focuses on specific utility functions (CRRA, SARA) and may not generalize to other risk preference frameworks

Future Work

- Explore multi-dimensional risk preference modeling beyond single-utility function alignment

- Investigate the impact of temporal discounting and loss aversion in decision-making frameworks

- Develop domain-specific fine-tuning protocols for different application areas

Paper Details

PDF Preview

Similar Papers

Found 5 papersLLMs for clinical risk prediction

Mohamed Rezk, Patricia Cabanillas Silva, Fried-Michael Dahlweid

EdgeProfiler: A Fast Profiling Framework for Lightweight LLMs on Edge Using Analytical Model

Md Rubel Ahmed, Alyssa Pinnock, Shakya Jayakody et al.

From Millions of Tweets to Actionable Insights: Leveraging LLMs for User Profiling

Masoud Asadpour, Azadeh Shakery, Vahid Rahimzadeh et al.

Psychological Profiling in Cybersecurity: A Look at LLMs and Psycholinguistic Features

Jean Marie Tshimula, Hugues Kanda, René Manassé Galekwa et al.

Comments (0)