Summary

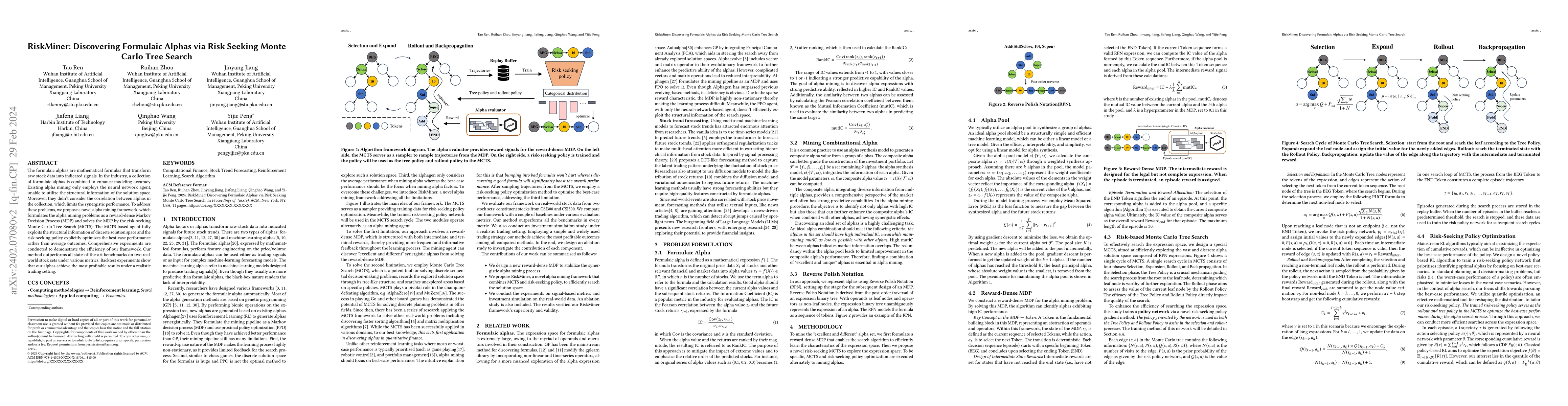

The formulaic alphas are mathematical formulas that transform raw stock data into indicated signals. In the industry, a collection of formulaic alphas is combined to enhance modeling accuracy. Existing alpha mining only employs the neural network agent, unable to utilize the structural information of the solution space. Moreover, they didn't consider the correlation between alphas in the collection, which limits the synergistic performance. To address these problems, we propose a novel alpha mining framework, which formulates the alpha mining problems as a reward-dense Markov Decision Process (MDP) and solves the MDP by the risk-seeking Monte Carlo Tree Search (MCTS). The MCTS-based agent fully exploits the structural information of discrete solution space and the risk-seeking policy explicitly optimizes the best-case performance rather than average outcomes. Comprehensive experiments are conducted to demonstrate the efficiency of our framework. Our method outperforms all state-of-the-art benchmarks on two real-world stock sets under various metrics. Backtest experiments show that our alphas achieve the most profitable results under a realistic trading setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers$\text{Alpha}^2$: Discovering Logical Formulaic Alphas using Deep Reinforcement Learning

Xinyu Zhang, Feng Xu, Shengyi Jiang et al.

Monte Carlo Search Algorithms Discovering Monte Carlo Tree Search Exploration Terms

Tristan Cazenave

Holistically Guided Monte Carlo Tree Search for Intricate Information Seeking

Wenjie Wang, Yuhao Wang, Jinhao Jiang et al.

Symbolic Physics Learner: Discovering governing equations via Monte Carlo tree search

Yang Liu, Hao Sun, Jian-Xun Wang et al.

No citations found for this paper.

Comments (0)