Summary

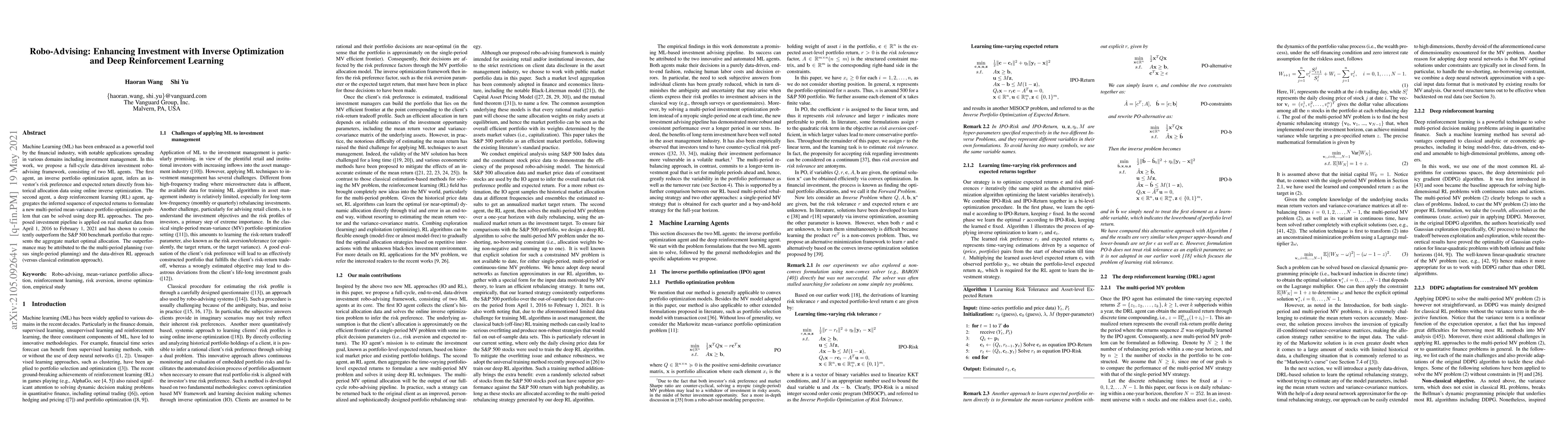

Machine Learning (ML) has been embraced as a powerful tool by the financial industry, with notable applications spreading in various domains including investment management. In this work, we propose a full-cycle data-driven investment robo-advising framework, consisting of two ML agents. The first agent, an inverse portfolio optimization agent, infers an investor's risk preference and expected return directly from historical allocation data using online inverse optimization. The second agent, a deep reinforcement learning (RL) agent, aggregates the inferred sequence of expected returns to formulate a new multi-period mean-variance portfolio optimization problem that can be solved using deep RL approaches. The proposed investment pipeline is applied on real market data from April 1, 2016 to February 1, 2021 and has shown to consistently outperform the S&P 500 benchmark portfolio that represents the aggregate market optimal allocation. The outperformance may be attributed to the the multi-period planning (versus single-period planning) and the data-driven RL approach (versus classical estimation approach).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)