Authors

Summary

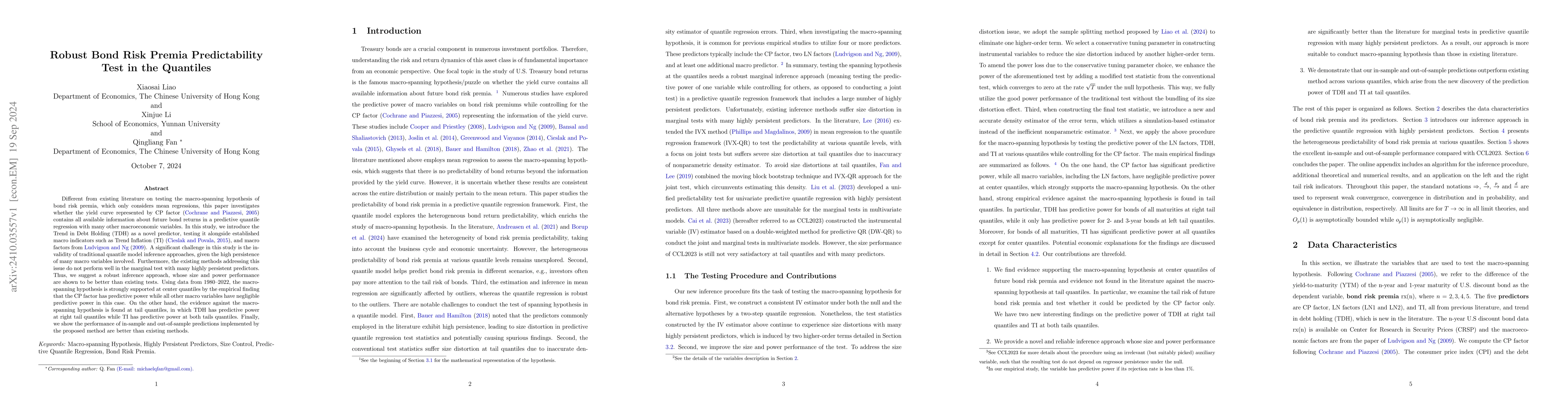

Different from existing literature on testing the macro-spanning hypothesis of bond risk premia, which only considers mean regressions, this paper investigates whether the yield curve represented by CP factor (Cochrane and Piazzesi, 2005) contains all available information about future bond returns in a predictive quantile regression with many other macroeconomic variables. In this study, we introduce the Trend in Debt Holding (TDH) as a novel predictor, testing it alongside established macro indicators such as Trend Inflation (TI) (Cieslak and Povala, 2015), and macro factors from Ludvigson and Ng (2009). A significant challenge in this study is the invalidity of traditional quantile model inference approaches, given the high persistence of many macro variables involved. Furthermore, the existing methods addressing this issue do not perform well in the marginal test with many highly persistent predictors. Thus, we suggest a robust inference approach, whose size and power performance are shown to be better than existing tests. Using data from 1980-2022, the macro-spanning hypothesis is strongly supported at center quantiles by the empirical finding that the CP factor has predictive power while all other macro variables have negligible predictive power in this case. On the other hand, the evidence against the macro-spanning hypothesis is found at tail quantiles, in which TDH has predictive power at right tail quantiles while TI has predictive power at both tails quantiles. Finally, we show the performance of in-sample and out-of-sample predictions implemented by the proposed method are better than existing methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersRobust Inference for Multiple Predictive Regressions with an Application on Bond Risk Premia

Qingliang Fan, Xiaosai Liao, Xinjue Li

Risk Premia in the Bitcoin Market

Ratmir Miftachov, Zijin Wang, Caio Almeida et al.

No citations found for this paper.

Comments (0)