Summary

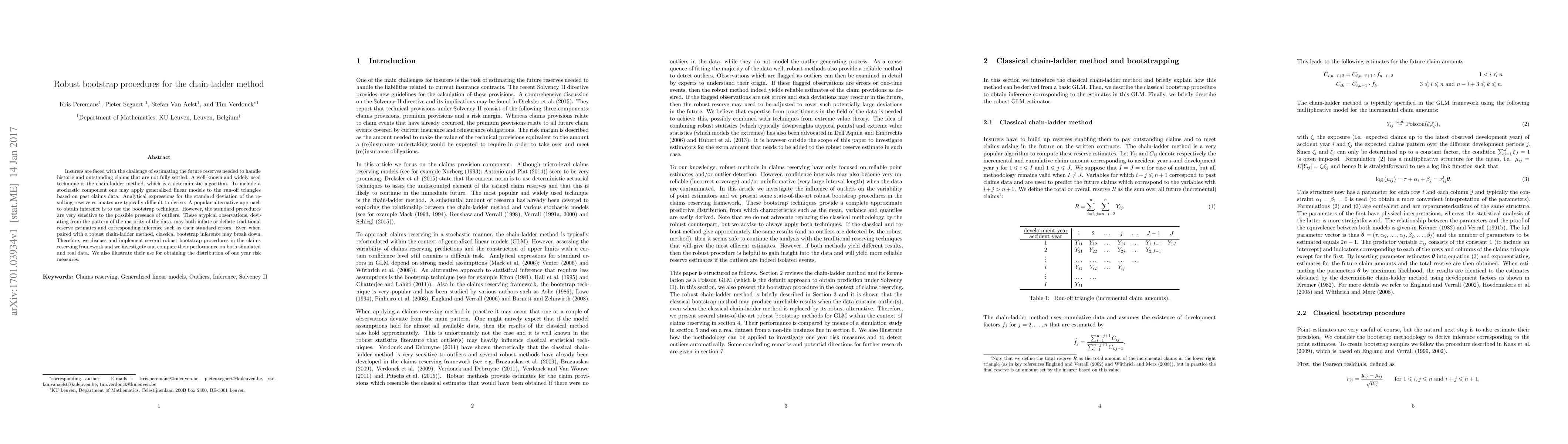

Insurers are faced with the challenge of estimating the future reserves needed to handle historic and outstanding claims that are not fully settled. A well-known and widely used technique is the chain-ladder method, which is a deterministic algorithm. To include a stochastic component one may apply generalized linear models to the run-off triangles based on past claims data. Analytical expressions for the standard deviation of the resulting reserve estimates are typically difficult to derive. A popular alternative approach to obtain inference is to use the bootstrap technique. However, the standard procedures are very sensitive to the possible presence of outliers. These atypical observations, deviating from the pattern of the majority of the data, may both inflate or deflate traditional reserve estimates and corresponding inference such as their standard errors. Even when paired with a robust chain-ladder method, classical bootstrap inference may break down. Therefore, we discuss and implement several robust bootstrap procedures in the claims reserving framework and we investigate and compare their performance on both simulated and real data. We also illustrate their use for obtaining the distribution of one year risk measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)