Authors

Summary

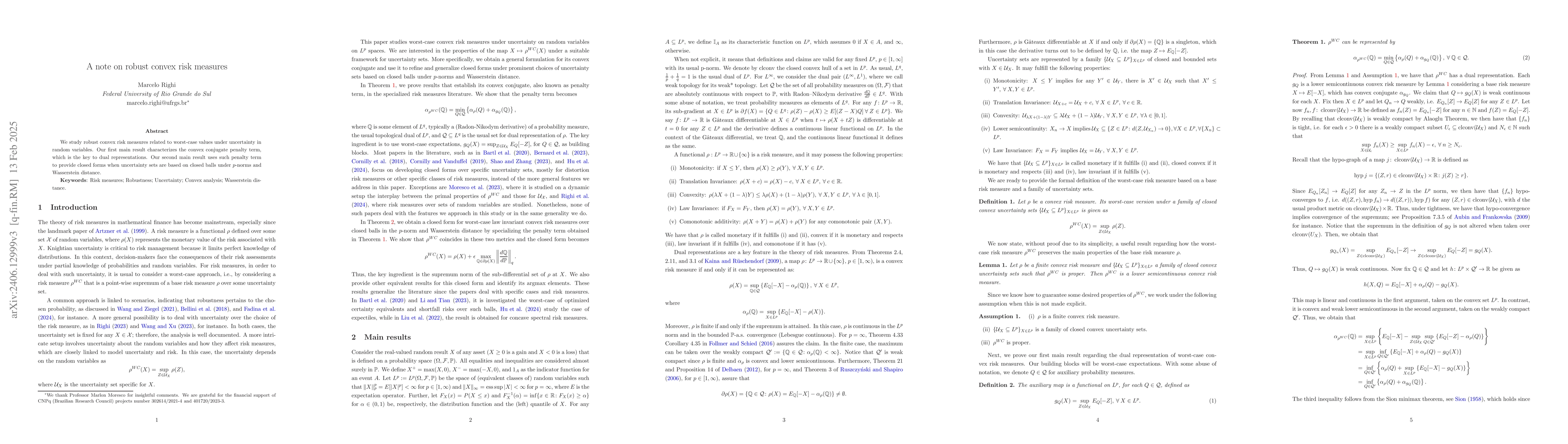

We study the general properties of robust convex risk measures as worst-case values under uncertainty on random variables. We establish general concrete results regarding convex conjugates and sub-differentials. We refine some results for closed forms of worstcase law invariant convex risk measures under two concrete cases of uncertainty sets for random variables: based on the first two moments and Wasserstein balls.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersOn Geometrically Convex Risk Measures

Roger J. A. Laeven, Fabio Bellini, Mücahit Aygün

| Title | Authors | Year | Actions |

|---|

Comments (0)