Summary

Economists often estimate economic models on data and use the point estimates as a stand-in for the truth when studying the model's implications for optimal decision-making. This practice ignores model ambiguity, exposes the decision problem to misspecification, and ultimately leads to post-decision disappointment. Using statistical decision theory, we develop a framework to explore, evaluate, and optimize robust decision rules that explicitly account for estimation uncertainty. We show how to operationalize our analysis by studying robust decisions in a stochastic dynamic investment model in which a decision-maker directly accounts for uncertainty in the model's transition dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

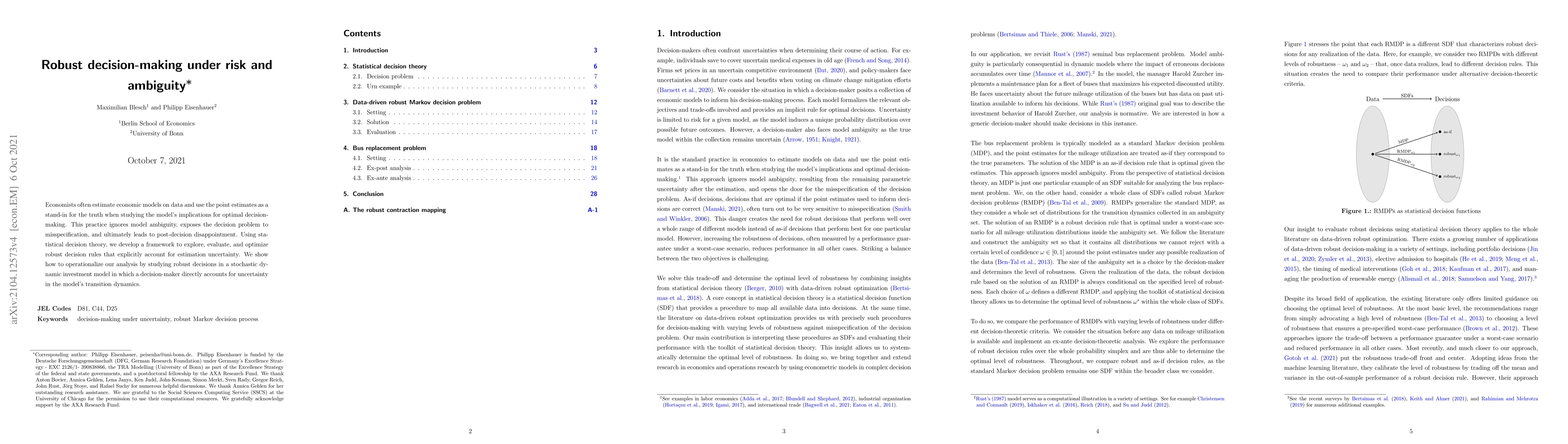

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDecision Making under Model Misspecification: DRO with Robust Bayesian Ambiguity Sets

Charita Dellaporta, Theodoros Damoulas, Patrick O'Hara

Decision Making under the Exponential Family: Distributionally Robust Optimisation with Bayesian Ambiguity Sets

Charita Dellaporta, Theodoros Damoulas, Patrick O'Hara

A Rank-Dependent Theory for Decision under Risk and Ambiguity

Roger J. A. Laeven, Mitja Stadje

| Title | Authors | Year | Actions |

|---|

Comments (0)