Summary

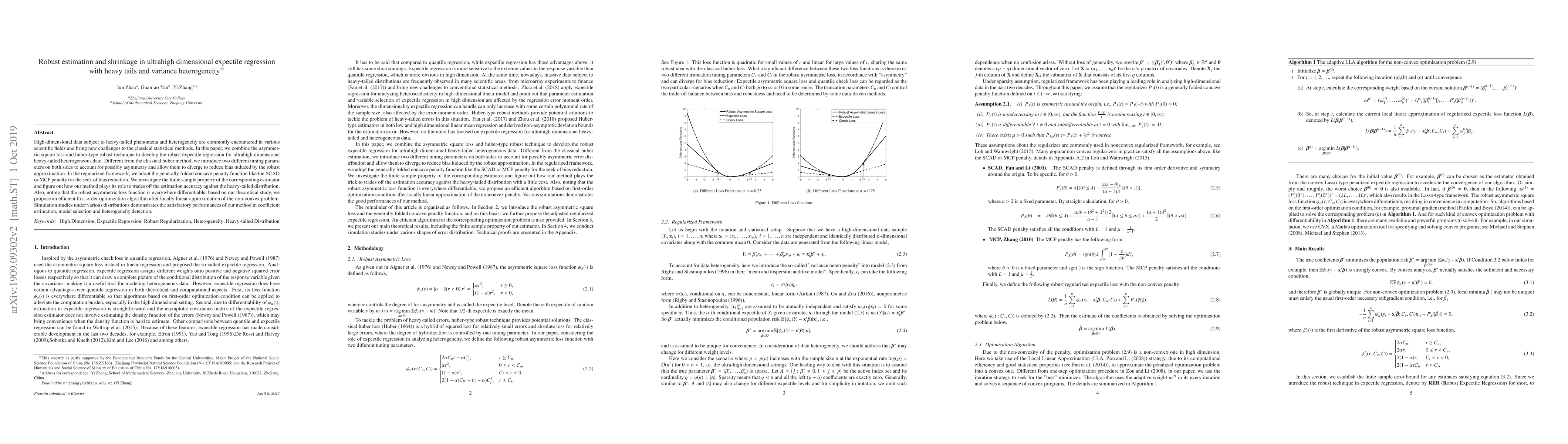

High-dimensional data subject to heavy-tailed phenomena and heterogeneity are commonly encountered in various scientific fields and bring new challenges to the classical statistical methods. In this paper, we combine the asymmetric square loss and huber-type robust technique to develop the robust expectile regression for ultrahigh dimensional heavy-tailed heterogeneous data. Different from the classical huber method, we introduce two different tuning parameters on both sides to account for possibly asymmetry and allow them to diverge to reduce bias induced by the robust approximation. In the regularized framework, we adopt the generally folded concave penalty function like the SCAD or MCP penalty for the seek of bias reduction. We investigate the finite sample property of the corresponding estimator and figure out how our method plays its role to trades off the estimation accuracy against the heavy-tailed distribution. Also, noting that the robust asymmetric loss function is everywhere differentiable, based on our theoretical study, we propose an efficient first-order optimization algorithm after locally linear approximation of the non-convex problem. Simulation studies under various distributions demonstrates the satisfactory performances of our method in coefficient estimation, model selection and heterogeneity detection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)