Authors

Summary

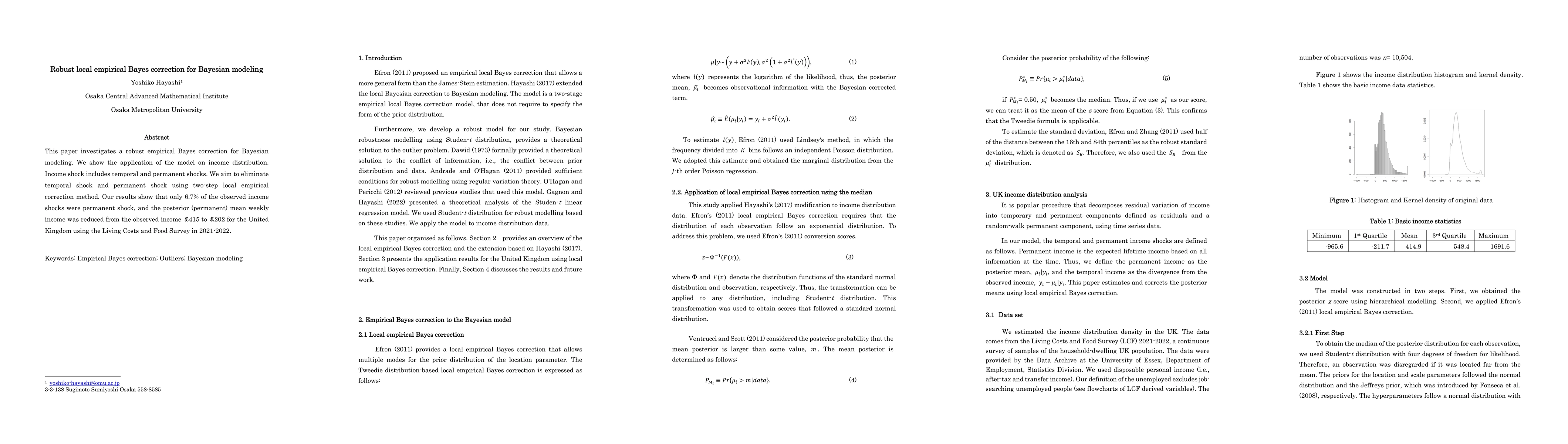

This paper investigates a robust empirical Bayes correction for Bayesian modeling. We show the application of the model on income distribution. Income shock includes temporal and permanent shocks. We aim to eliminate temporal shock and permanent shock using two-step local empirical correction method. Our results show that only 6.7% of the observed income shocks were permanent shock, and the posterior (permanent) mean weekly income was reduced from the observed income 415 pounds to 202 pounds for the United Kingdom using the Living Costs and Food Survey in 2021-2022. Keywords: Empirical Bayes correction; Outliers; Bayesian modeling

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a two-step local empirical Bayes correction method using hierarchical modeling and Poisson regression to analyze income distribution data from the UK Living Costs and Food Survey (LCF) 2021-2022.

Key Results

- Only 6.7% of income shocks observed are permanent shocks.

- The corrected mean weekly income for the UK is £202, a reduction from the uncorrected observed income of £415.

- The standard deviation of the corrected posterior z scores is reduced by 42.4% compared to the non-corrected posterior z scores.

Significance

This research is important as it provides a robust method for correcting Bayesian modeling in the presence of outliers, specifically in income distribution analysis, leading to more accurate estimates of permanent and temporary income shocks.

Technical Contribution

The paper introduces a robust local empirical Bayes correction method for Bayesian modeling, specifically tailored for addressing outliers in income distribution data.

Novelty

The novelty of this work lies in its application of a two-step local empirical Bayes correction method to Bayesian modeling, which effectively reduces the impact of outliers and provides more accurate estimates of permanent and temporary income shocks.

Limitations

- The study is limited to the UK income distribution data from the LCF 2021-2022 survey.

- The methodology may not generalize well to other types of datasets or income distribution models without further validation.

Future Work

- Further exploration of the method's applicability to other countries' income distribution data.

- Investigating the performance of the proposed method with diverse datasets to ensure its robustness and generalizability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Empirical Bayes Confidence Intervals

Michal Kolesár, Mikkel Plagborg-Møller, Timothy B. Armstrong

No citations found for this paper.

Comments (0)