Authors

Summary

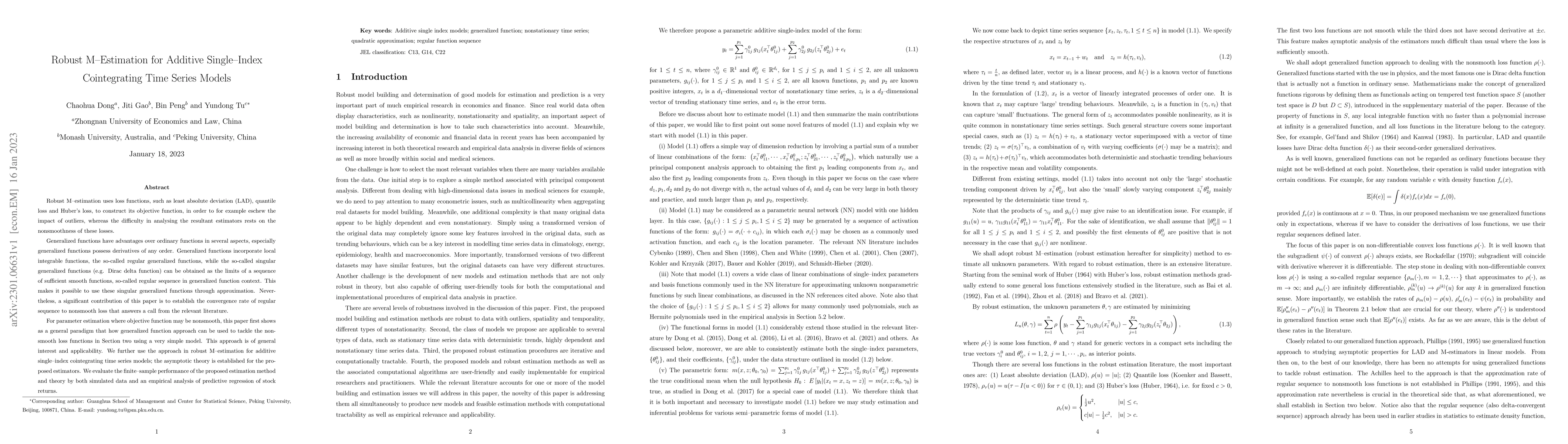

Robust M-estimation uses loss functions, such as least absolute deviation (LAD), quantile loss and Huber's loss, to construct its objective function, in order to for example eschew the impact of outliers, whereas the difficulty in analysing the resultant estimators rests on the nonsmoothness of these losses. Generalized functions have advantages over ordinary functions in several aspects, especially generalized functions possess derivatives of any order. Generalized functions incorporate local integrable functions, the so-called regular generalized functions, while the so-called singular generalized functions (e.g. Dirac delta function) can be obtained as the limits of a sequence of sufficient smooth functions, so-called regular sequence in generalized function context. This makes it possible to use these singular generalized functions through approximation. Nevertheless, a significant contribution of this paper is to establish the convergence rate of regular sequence to nonsmooth loss that answers a call from the relevant literature. For parameter estimation where objective function may be nonsmooth, this paper first shows as a general paradigm that how generalized function approach can be used to tackle the nonsmooth loss functions in Section two using a very simple model. This approach is of general interest and applicability. We further use the approach in robust M-estimation for additive single-index cointegrating time series models; the asymptotic theory is established for the proposed estimators. We evaluate the finite-sample performance of the proposed estimation method and theory by both simulated data and an empirical analysis of predictive regression of stock returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)