Summary

The existing literature on optimal auctions focuses on optimizing the expected revenue of the seller, and is appropriate for risk-neutral sellers. In this paper, we identify good mechanisms for risk-averse sellers. As is standard in the economics literature, we model the risk-aversion of a seller by endowing the seller with a monotone concave utility function. We then seek robust mechanisms that are approximately optimal for all sellers, no matter what their levels of risk-aversion are. We have two main results for multi-unit auctions with unit-demand bidders whose valuations are drawn i.i.d. from a regular distribution. First, we identify a posted-price mechanism called the Hedge mechanism, which gives a universal constant factor approximation; we also show for the unlimited supply case that this mechanism is in a sense the best possible. Second, we show that the VCG mechanism gives a universal constant factor approximation when the number of bidders is even only a small multiple of the number of items. Along the way we point out that Myerson's characterization of the optimal mechanisms fails to extend to utility-maximization for risk-averse sellers, and establish interesting properties of regular distributions and monotone hazard rate distributions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

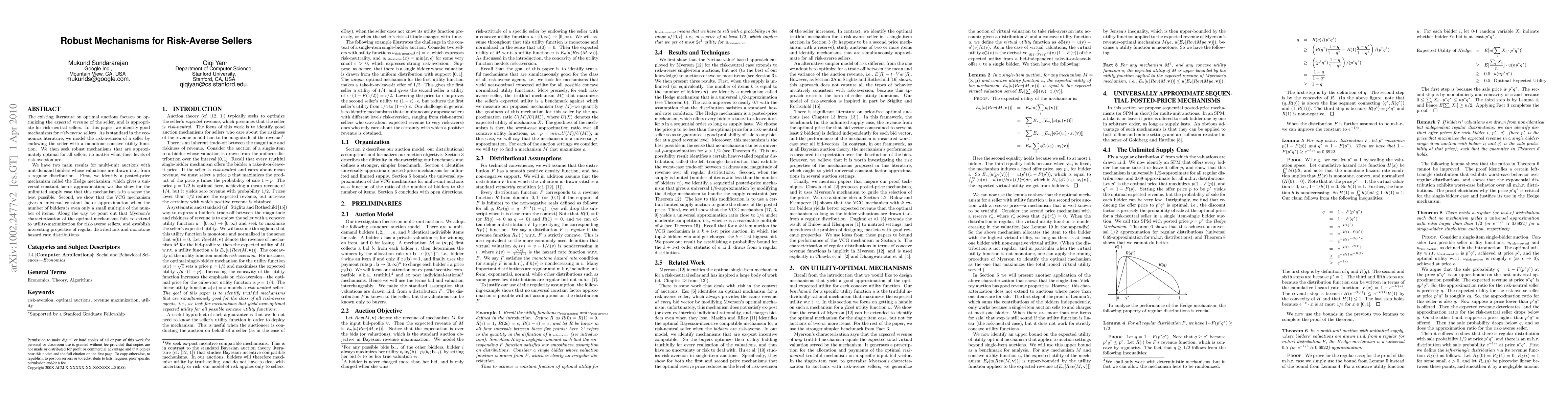

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRASR: Risk-Averse Soft-Robust MDPs with EVaR and Entropic Risk

Marek Petrik, Jia Lin Hau, Mohammad Ghavamzadeh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)