Authors

Summary

In this article, we address the challenge of identifying skilled mutual funds among a large pool of candidates, utilizing the linear factor pricing model. Assuming observable factors with a weak correlation structure for the idiosyncratic error, we propose a spatial-sign based multiple testing procedure (SS-BH). When latent factors are present, we first extract them using the elliptical principle component method (He et al. 2022) and then propose a factor-adjusted spatial-sign based multiple testing procedure (FSS-BH). Simulation studies demonstrate that our proposed FSS-BH procedure performs exceptionally well across various applications and exhibits robustness to variations in the covariance structure and the distribution of the error term. Additionally, real data application further highlights the superiority of the FSS-BH procedure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

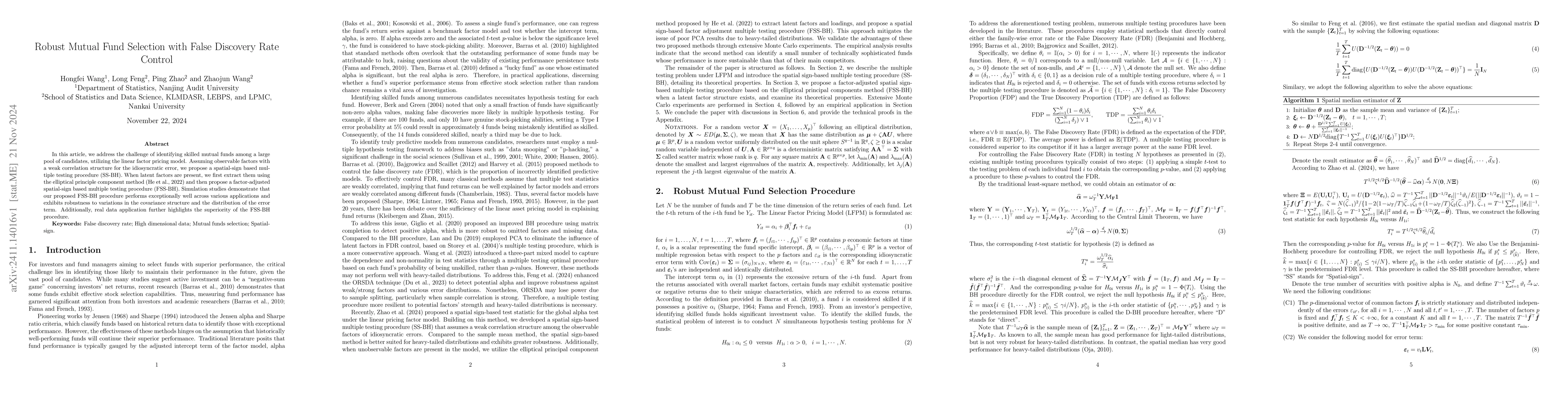

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSkilled Mutual Fund Selection: False Discovery Control under Dependence

Xu Han, Xin Tong, Lijia Wang

StarTrek: Combinatorial Variable Selection with False Discovery Rate Control

Lu Zhang, Junwei Lu

No citations found for this paper.

Comments (0)