Summary

A market model with $d$ assets in discrete time is considered where trades are subject to proportional transaction costs given via bid-ask spreads, while the existence of a num\`eraire is not assumed. It is shown that robust no arbitrage holds if, and only if, there exists a Pareto solution for some vector-valued utility maximization problem with component-wise utility functions. Moreover, it is demonstrated that a consistent price process can be constructed from the Pareto maximizer.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

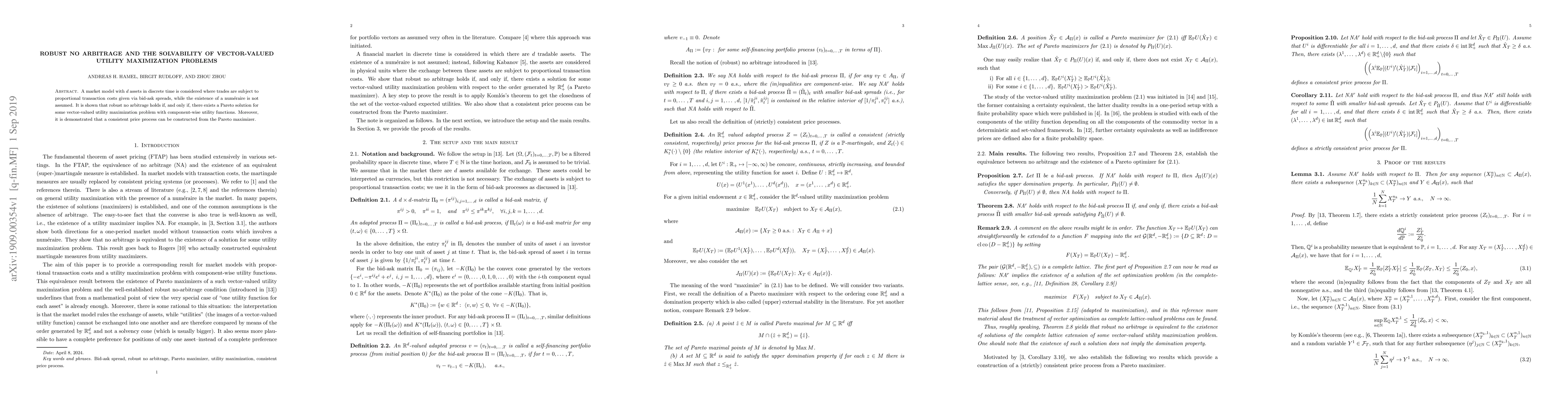

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)