Summary

This paper investigates the problem of maximizing expected terminal utility in a discrete-time financial market model with a finite horizon under non-dominated model uncertainty. We use a dynamic programming framework together with measurable selection arguments to prove that under mild integrability conditions, an optimal portfolio exists for an unbounded utility function defined on the half-real line.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

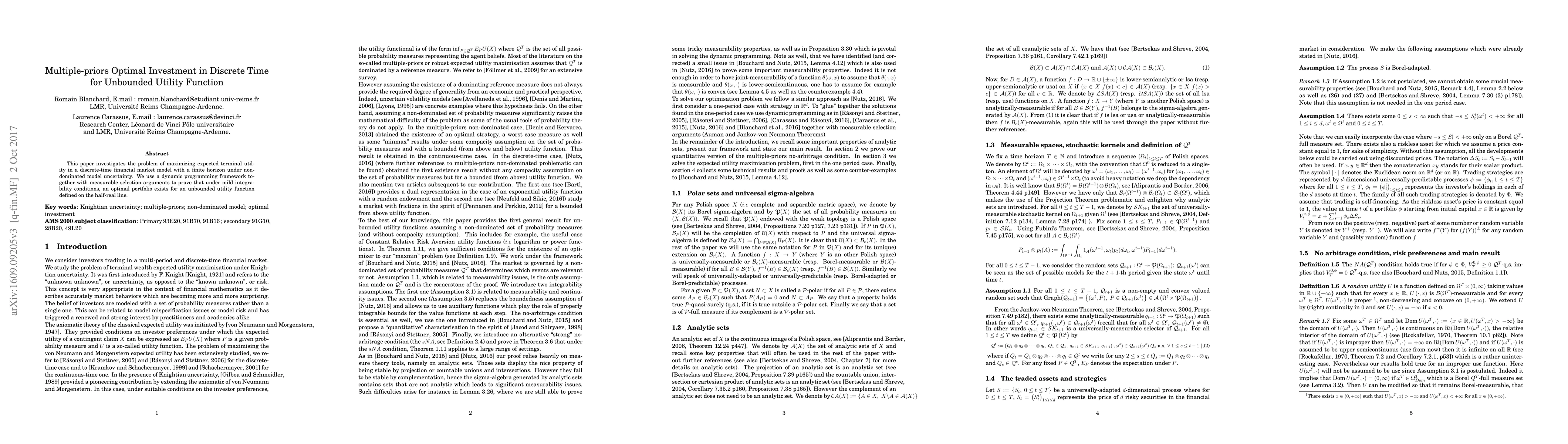

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiscrete time optimal investment under model uncertainty

Laurence Carassus, Massinissa Ferhoune

Consumption-investment optimization with Epstein-Zin utility in unbounded non-Markovian markets

Harry Zheng, Dejian Tian, Zixin Feng

| Title | Authors | Year | Actions |

|---|

Comments (0)