Summary

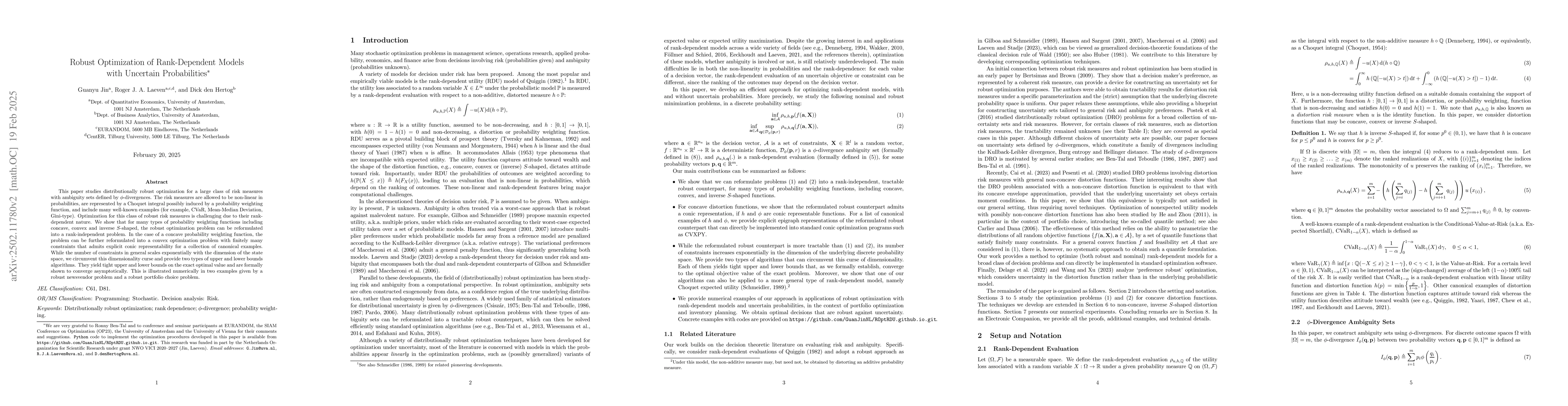

This paper studies distributionally robust optimization for a large class of risk measures with ambiguity sets defined by $\phi$-divergences. The risk measures are allowed to be non-linear in probabilities, are represented by a Choquet integral possibly induced by a probability weighting function, and include many well-known examples (for example, CVaR, Mean-Median Deviation, Gini-type). Optimization for this class of robust risk measures is challenging due to their rank-dependent nature. We show that for many types of probability weighting functions including concave, convex and inverse $S$-shaped, the robust optimization problem can be reformulated into a rank-independent problem. In the case of a concave probability weighting function, the problem can be further reformulated into a convex optimization problem with finitely many constraints that admits explicit conic representability for a collection of canonical examples. While the number of constraints in general scales exponentially with the dimension of the state space, we circumvent this dimensionality curse and provide two types of upper and lower bounds algorithms. They yield tight upper and lower bounds on the exact optimal value and are formally shown to converge asymptotically. This is illustrated numerically in two examples given by a robust newsvendor problem and a robust portfolio choice problem.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper studies distributionally robust optimization for a class of risk measures using phi-divergences, allowing for non-linear dependencies on probabilities and rank-dependent utility models. It demonstrates reformulation of the robust optimization problem into rank-independent problems for certain distortion functions, including concave ones, which can be further transformed into convex optimization problems with explicit conic representability for specific examples.

Key Results

- Robust optimization problems involving rank-dependent models can be reformulated into rank-independent, tractable optimization problems.

- For concave distortion functions, the reformulation admits a conic representation, explicitly derived for canonical distortion and divergence functions.

- Two types of upper and lower bound algorithms are developed to circumvent the curse of dimensionality, formally shown to converge asymptotically.

- The method's performance is illustrated through numerical examples, including a robust newsvendor problem and a robust portfolio choice problem.

- The approach can be extended to encompass robust optimization problems with general law-invariant convex functionals.

Significance

This research is significant as it provides a framework for handling ambiguity in risk measures, which is crucial in decision-making under uncertainty. The findings offer a way to transform complex, rank-dependent optimization problems into more manageable forms, facilitating practical applications in inventory management and portfolio optimization.

Technical Contribution

The paper presents a method for reformulating robust optimization problems involving rank-dependent utility models into rank-independent problems, providing conic representations for certain distortion functions and developing upper and lower bound algorithms to handle high-dimensional problems.

Novelty

The novelty lies in the reformulation of rank-dependent optimization problems into rank-independent ones, the explicit conic representation for specific distortion functions, and the development of efficient upper and lower bound algorithms to address the curse of dimensionality.

Limitations

- The number of constraints in the reformulated problem scales exponentially with the dimension of the state space.

- The algorithms' efficiency may be affected by the dimensionality of the underlying probability space.

- The paper focuses on specific types of distortion functions and divergence measures, which may limit its applicability to other scenarios without further adaptation.

Future Work

- Investigate the applicability of the approach to other types of distortion functions and divergence measures.

- Explore methods to reduce the exponential growth of constraints with state space dimension.

- Extend the framework to handle more complex decision-making problems under uncertainty.

Paper Details

PDF Preview

Similar Papers

Found 4 papersRobust Optimization with Decision-Dependent Information Discovery

Han Yu, Angelos Georghiou, Phebe Vayanos

Efficient Robust Bayesian Optimization for Arbitrary Uncertain Inputs

Lin Yang, Zhitang Chen, Junlong Lyu et al.

No citations found for this paper.

Comments (0)