Authors

Summary

In the international oil trade network (iOTN), trade shocks triggered by extreme events may spread over the entire network along the trade links of the central economies and even lead to the collapse of the whole system. In this study, we focus on the concept of "too central to fail" and use traditional centrality indicators as strategic indicators for simulating attacks on economic nodes, and simulates various situations in which the structure and function of the global oil trade network are lost when the economies suffer extreme trade shocks. The simulation results show that the global oil trade system has become more vulnerable in recent years. The regional aggregation of oil trade is an essential source of iOTN's vulnerability. Maintaining global oil trade stability and security requires a focus on economies with greater influence within the network module of the iOTN. International organizations such as OPEC and OECD established more trade links around the world, but their influence on the iOTN is declining. We improve the framework of oil security and trade risk assessment based on the topological index of iOTN, and provide a reference for finding methods to maintain network robustness and trade stability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

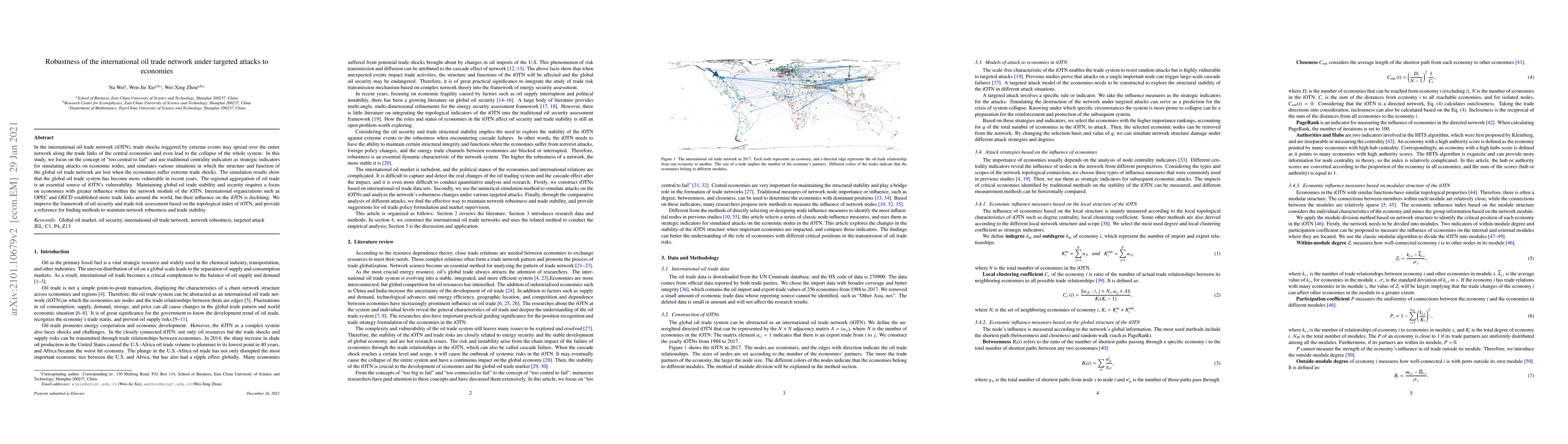

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn interpretable machine-learned model for international oil trade network

Wei-Xing Zhou, Na Wei, Wen-Jie Xie

Evolving efficiency and robustness of global oil trade networks

Wei-Xing Zhou, Na Wei, Wen-Jie Xie

Impact of shocks to economies on the efficiency and robustness of the international pesticide trade networks

Li Wang, Wei-Xing Zhou, Wen-Jie Xie et al.

Resilience of international oil trade networks under extreme event shock-recovery simulations

Wei-Xing Zhou, Na Wei, Wen-Jie Xie

| Title | Authors | Year | Actions |

|---|

Comments (0)