Summary

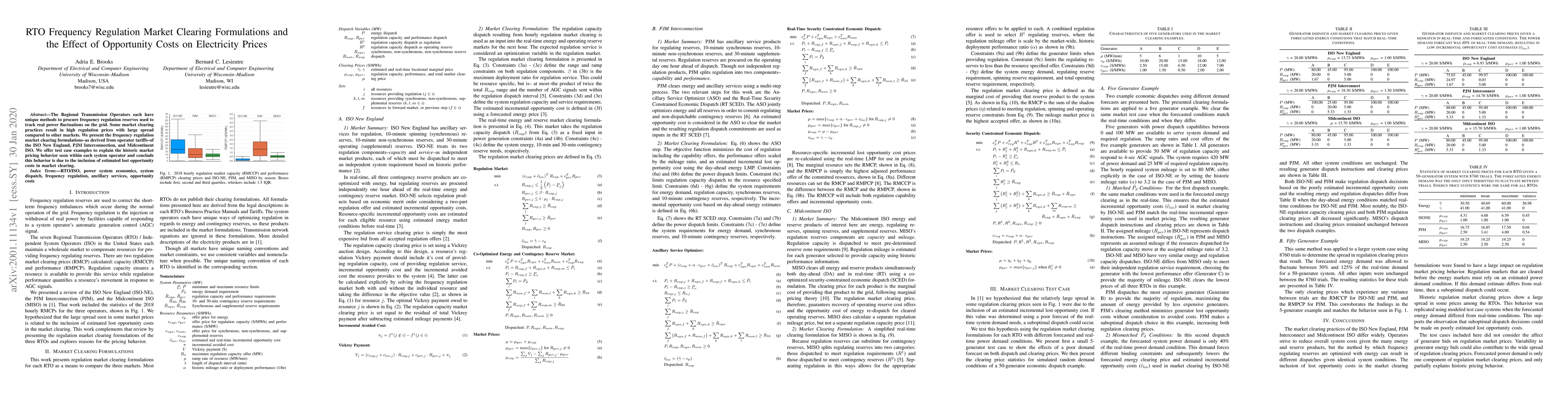

The Regional Transmission Operators each have unique methods to procure frequency regulation reserves used to track real power fluctuations on the grid. Some market clearing practices result in high regulation prices with large spread compared to other markets. We present the frequency regulation market clearing formulations--as derived from operator tariffs--of the ISO New England, PJM Interconnection, and Midcontinent ISO. We offer test case examples to explain the historic market pricing behavior seen within each system operator and conclude this behavior is due to the inclusion of estimated lost opportunity costs in market clearing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNew Formulations and Pricing Mechanisms for Stochastic Electricity Market Clearing Problem

Harsha Gangammanavar, Sakitha Ariyarathne

Greening the Grid: Electricity Market Clearing with Consumer-Based Carbon Cost

Line Roald, Wenqian Jiang

| Title | Authors | Year | Actions |

|---|

Comments (0)