Summary

We consider a generalization of the classical risk model when the premium intensity depends on the current surplus of an insurance company. All surplus is invested in the risky asset, the price of which follows a geometric Brownian motion. We get an exponential bound for the infinite-horizon ruin probability. To this end, we allow the surplus process to explode and investigate the question concerning the probability of explosion of the surplus process between claim arrivals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

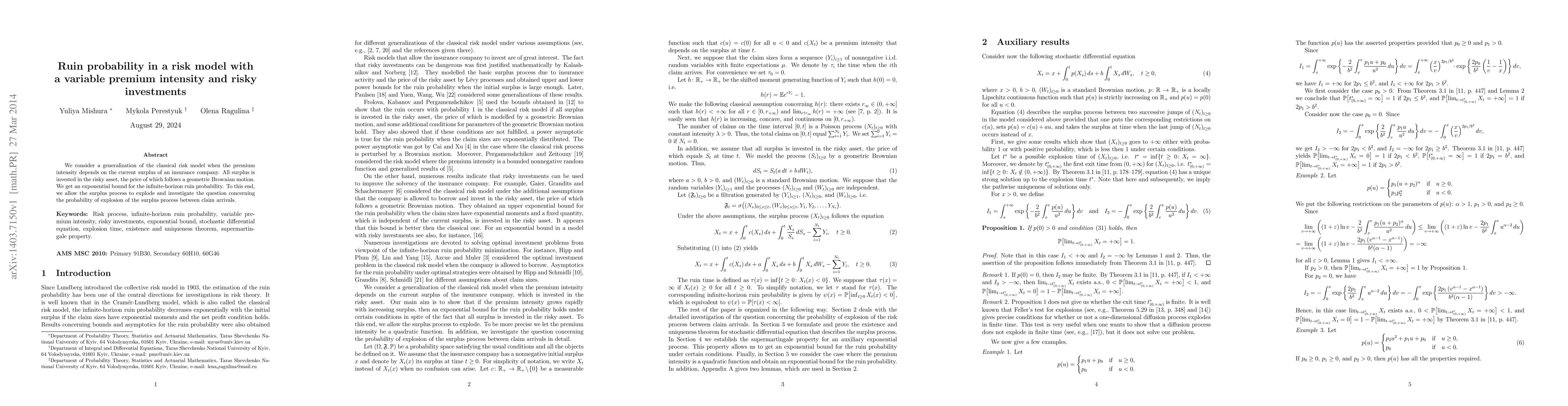

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)