Summary

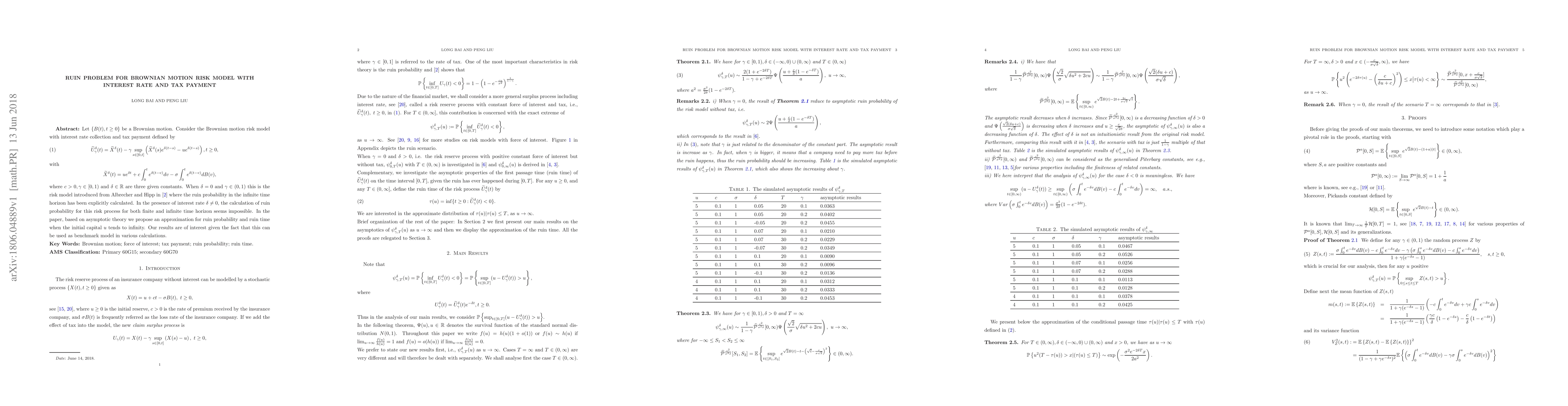

Let $\{B(t), t\ge 0\}$ be a Brownian motion. Consider the Brownian motion risk model with interest rate collection and tax payment defined by \begin{align}\label{Rudef} \widetilde{U}_\gamma^\delta(t)=\widetilde{X}^\delta(t)-\gamma\sup_{s\in[0,t]} \left(\widetilde{X}^\delta(s)e^{\delta(t-s)}-ue^{\delta(t-s)}\right),t\ge0, \end{align} with $$\widetilde{X}^\delta(t)=ue^{\delta t}+c \int_0^t e^{\delta (t-v)}dv-\sigma \int_0^t e^{\delta(t-v)}dB(v),$$ where $c>0,\gamma \in [0,1)$ and $\delta \in \mathbb{R}$ are three given constants. When $\delta=0$ and $\gamma \in (0,1)$ this is the risk model introduced from Albrecher and Hipp in \cite{AH2007} where the ruin probability in the infinite time horizon has been explicitly calculated. In the presence of interest rate $\delta\neq0$, the calculation of ruin probability for this risk process for both finite and infinite time horizon seems impossible. In the paper, based on asymptotic theory we propose an approximation for ruin probability and ruin time when the initial capital $u$ tends to infinity. Our results are of interest given the fact that this can be used as benchmark model in various calculations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)