Summary

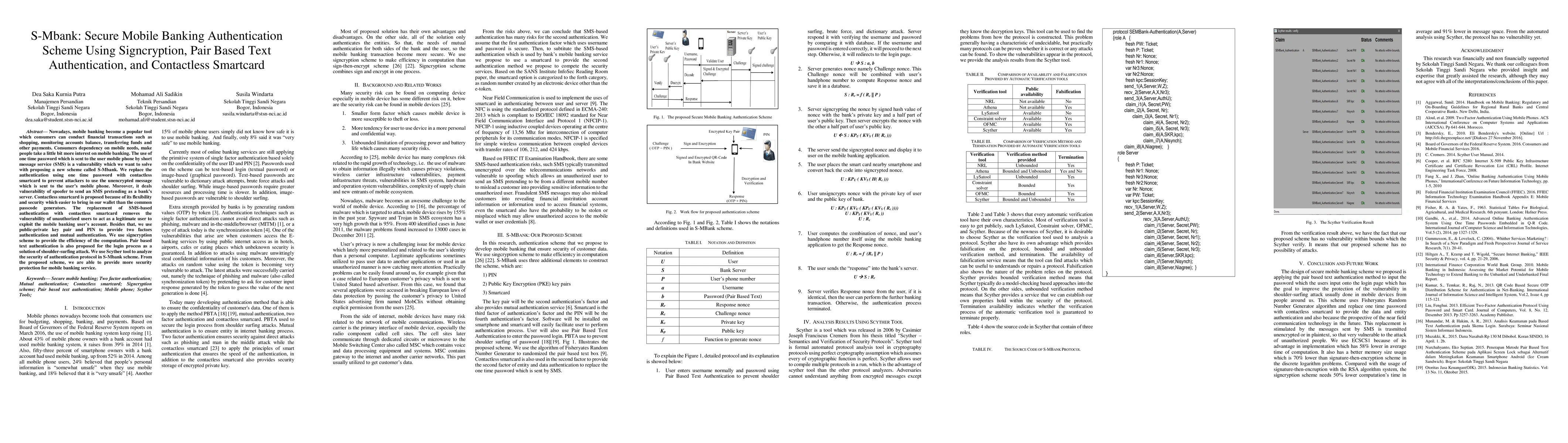

Nowadays, mobile banking becomes a popular tool which consumers can conduct financial transactions such as shopping, monitoring accounts balance, transferring funds and other payments. Consumers dependency on mobile needs, make people take a little bit more interest in mobile banking. The use of the one-time password which is sent to the user mobile phone by short message service (SMS) is a vulnerability which we want to solve with proposing a new scheme called S-Mbank. We replace the authentication using the one-time password with the contactless smart card to prevent attackers to use the unencrypted message which is sent to the user's mobile phone. Moreover, it deals vulnerability of spoofer to send an SMS pretending as a bank's server. The contactless smart card is proposed because of its flexibility and security which easier to bring in our wallet than the common passcode generators. The replacement of SMS-based authentication with contactless smart card removes the vulnerability of unauthorized users to act as a legitimate user to exploit the mobile banking user's account. Besides that, we use public-private key pair and PIN to provide two factors authentication and mutual authentication. We use signcryption scheme to provide the efficiency of the computation. Pair based text authentication is also proposed for the login process as a solution to shoulder-surfing attack. We use Scyther tool to analyze the security of authentication protocol in S-Mbank scheme. From the proposed scheme, we are able to provide more security protection for mobile banking service.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-layered Authentication and Key Management Scheme for Secure IoV

Gunes Karabulut Kurt, Nesrine Benchoubane, Enver Ozdemir et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)