Summary

We consider the regularity of sample paths of Volterra processes. These processes are defined as stochastic integrals $$ M(t)=\int_{0}^{t}F(t,r)dX(r), \ \ t \in \mathds{R}_{+}, $$ where $X$ is a semimartingale and $F$ is a deterministic real-valued function. We derive the information on the modulus of continuity for these processes under regularity assumptions on the function $F$ and show that $M(t)$ has "worst" regularity properties at times of jumps of $X(t)$. We apply our results to obtain the optimal H\"older exponent for fractional L\'{e}vy processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

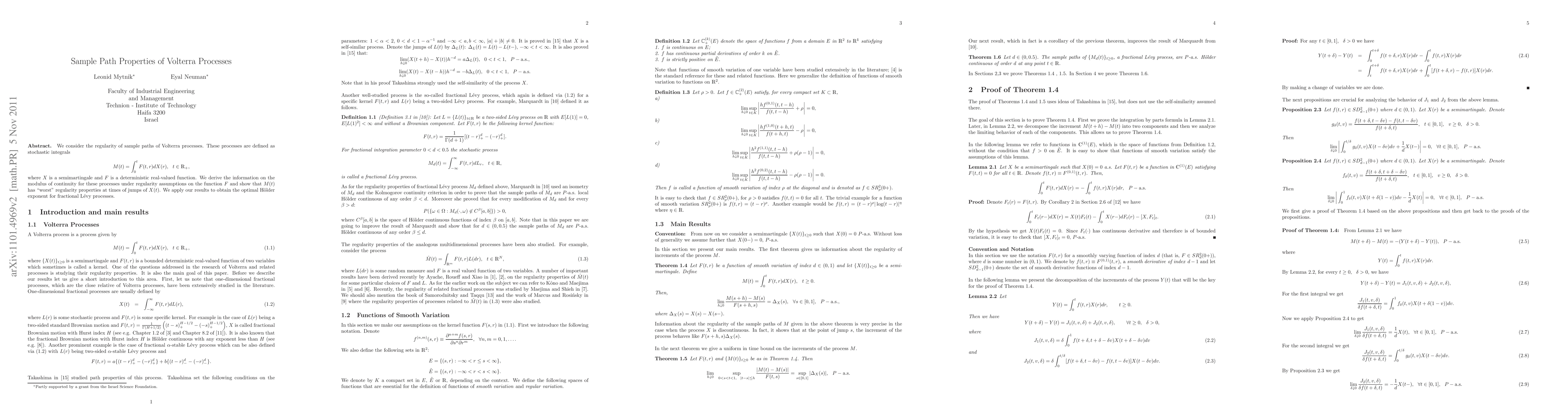

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLocal times of self-intersection and sample path properties of Volterra Gaussian processes

Wasiur R. KhudaBukhsh, Olga Izyumtseva

Tail behavior and sample path properties of positive supOU processes

Danijel Grahovac, Peter Kevei

| Title | Authors | Year | Actions |

|---|

Comments (0)