Summary

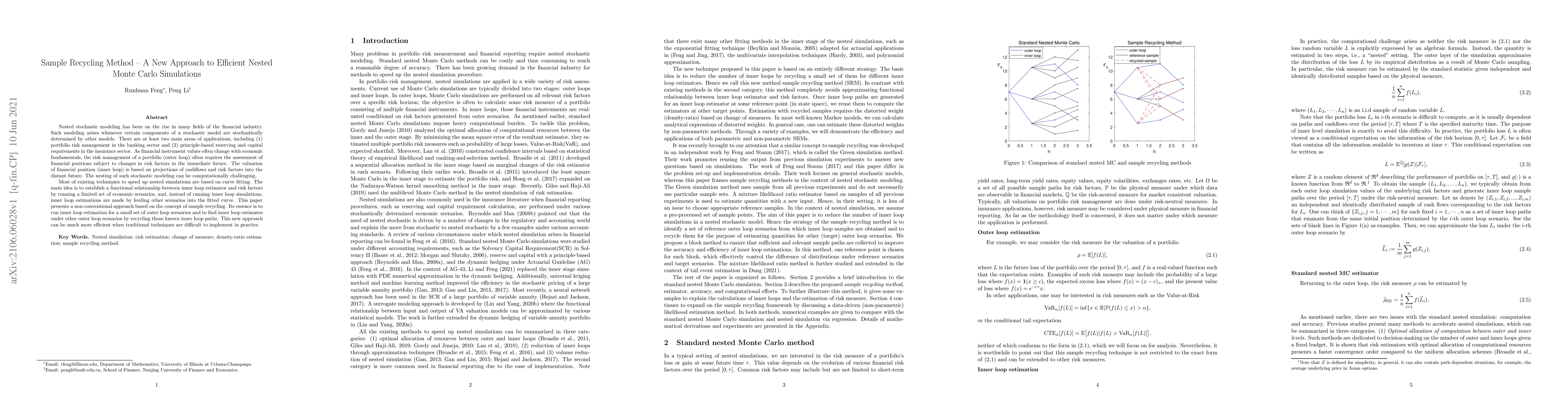

Nested stochastic modeling has been on the rise in many fields of the financial industry. Such modeling arises whenever certain components of a stochastic model are stochastically determined by other models. There are at least two main areas of applications, including (1) portfolio risk management in the banking sector and (2) principle-based reserving and capital requirements in the insurance sector. As financial instrument values often change with economic fundamentals, the risk management of a portfolio (outer loop) often requires the assessment of financial positions subject to changes in risk factors in the immediate future. The valuation of financial position (inner loop) is based on projections of cashflows and risk factors into the distant future. The nesting of such stochastic modeling can be computationally challenging. Most of existing techniques to speed up nested simulations are based on curve fitting. The main idea is to establish a functional relationship between inner loop estimator and risk factors by running a limited set of economic scenarios, and, instead of running inner loop simulations, inner loop estimations are made by feeding other scenarios into the fitted curve. This paper presents a non-conventional approach based on the concept of sample recycling. Its essence is to run inner loop estimation for a small set of outer loop scenarios and to find inner loop estimates under other outer loop scenarios by recycling those known inner loop paths. This new approach can be much more efficient when traditional techniques are difficult to implement in practice.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)