Authors

Summary

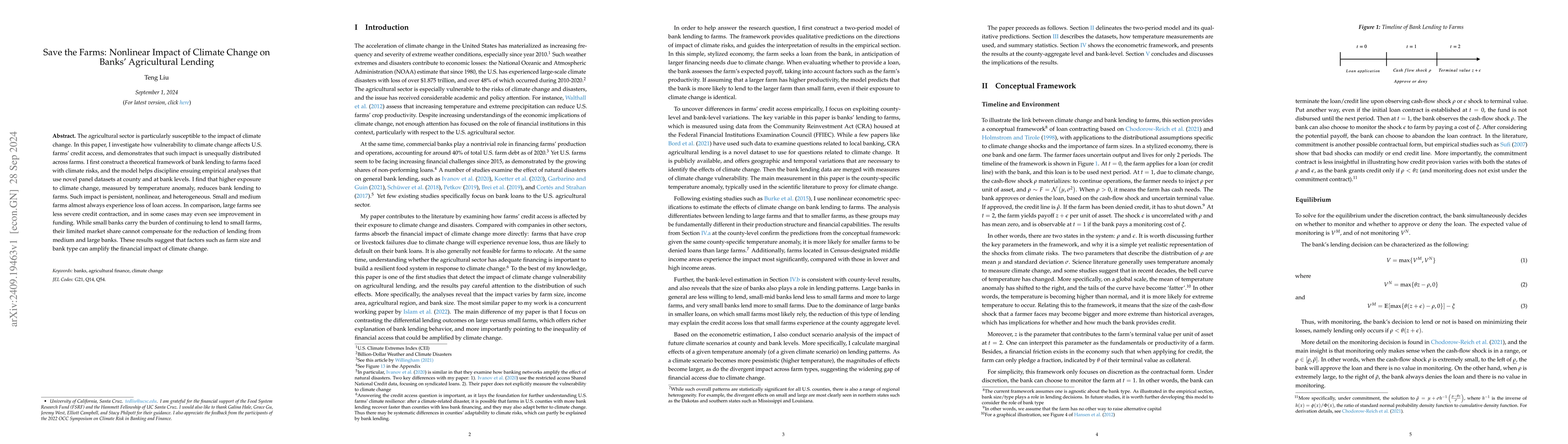

The agricultural sector is particularly susceptible to the impact of climate change. In this paper, I investigate how vulnerability to climate change affects U.S. farms' credit access, and demonstrates that such impact is unequally distributed across farms. I first construct a theoretical framework of bank lending to farms faced with climate risks, and the model helps discipline ensuing empirical analyses that use novel panel datasets at county and at bank levels. I find that higher exposure to climate change, measured by temperature anomaly, reduces bank lending to farms. Such impact is persistent, nonlinear, and heterogeneous. Small and medium farms almost always experience loss of loan access. In comparison, large farms see less severe credit contraction, and in some cases may even see improvement in funding. While small banks carry the burden of continuing to lend to small farms, their limited market share cannot compensate for the reduction of lending from medium and large banks. These results suggest that factors such as farm size and bank type can amplify the financial impact of climate change.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn model selection criteria for climate change impact studies

Bulat Gafarov, Dalia Ghanem, Todd Kuffner et al.

Climate Change Impact on Agricultural Land Suitability: An Interpretable Machine Learning-Based Eurasia Case Study

Yury Maximov, Valeriy Shevchenko, Daria Taniushkina et al.

No citations found for this paper.

Comments (0)