Summary

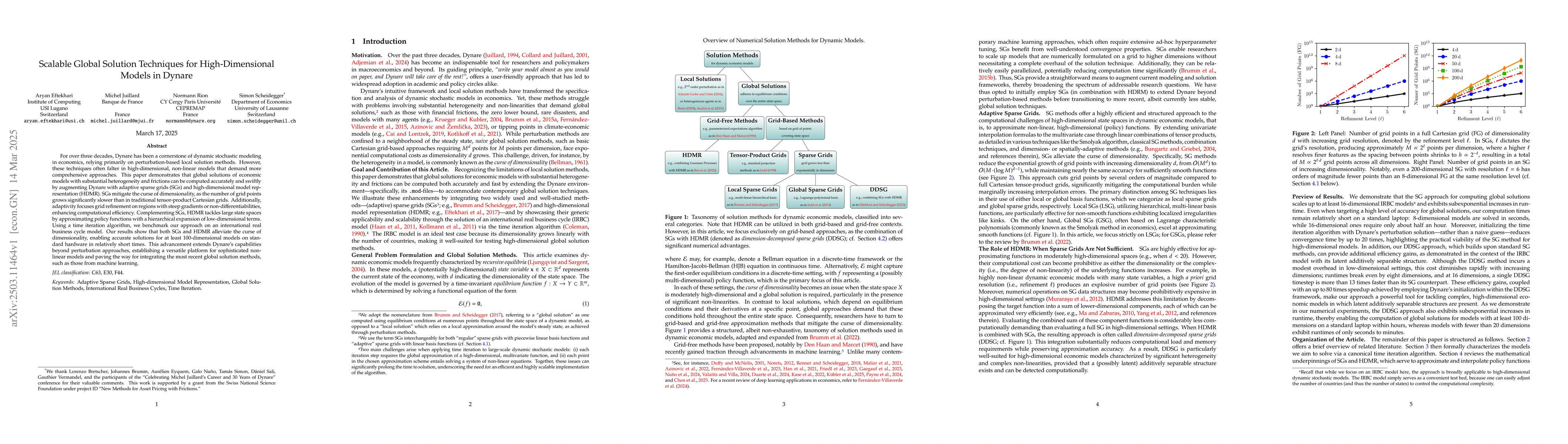

For over three decades, Dynare has been a cornerstone of dynamic stochastic modeling in economics, relying primarily on perturbation-based local solution methods. However, these techniques often falter in high-dimensional, non-linear models that demand more comprehensive approaches. This paper demonstrates that global solutions of economic models with substantial heterogeneity and frictions can be computed accurately and swiftly by augmenting Dynare with adaptive sparse grids (SGs) and high-dimensional model representation (HDMR). SGs mitigate the curse of dimensionality, as the number of grid points grows significantly slower than in traditional tensor-product Cartesian grids. Additionally, adaptivity focuses grid refinement on regions with steep gradients or non-differentiabilities, enhancing computational efficiency. Complementing SGs, HDMR tackles large state spaces by approximating policy functions with a hierarchical expansion of low-dimensional terms. Using a time iteration algorithm, we benchmark our approach on an international real business cycle model. Our results show that both SGs and HDMR alleviate the curse of dimensionality, enabling accurate solutions for at least 100-dimensional models on standard hardware in relatively short times. This advancement extends Dynare's capabilities beyond perturbation approaches, establishing a versatile platform for sophisticated non-linear models and paving the way for integrating the most recent global solution methods, such as those from machine learning.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research integrates sparse grids and high-dimensional model representation into Dynare's .mod files, enabling global solutions for high-dimensional, non-linear dynamic stochastic models.

Key Results

- Global solutions for high-dimensional models (up to 100 dimensions) can be computed accurately and swiftly on standard laptops within minutes to hours.

- The methods mitigate the curse of dimensionality, reducing time to solution by leveraging Dynare's perturbation-based initial guesses, yielding speedups of up to 80 times.

- Consistency in accuracy is maintained as model dimensionality increases.

- The approach significantly enhances Dynare's versatility, reinforcing its role as a vital tool for macroeconomic analysis.

Significance

This study broadens the range of models Dynare can handle, making it applicable to increasingly complex economic questions and preserving its relevance in the field.

Technical Contribution

The integration of sparse grids and high-dimensional model representation (HDMR) into Dynare, allowing for efficient global solutions of high-dimensional, non-linear dynamic stochastic models.

Novelty

This work extends Dynare's capabilities beyond perturbation approaches, establishing a versatile platform for sophisticated non-linear models and paving the way for integrating the most recent global solution methods, such as those from machine learning.

Limitations

- The current implementation does not include adaptivity for sparse grids, which could further improve computational efficiency.

- The research does not explore the integration of machine learning algorithms beyond the sparse grid and HDMR techniques.

Future Work

- Investigate adaptive sparse grid techniques to enhance computational efficiency.

- Explore the incorporation of more advanced machine learning algorithms for solving high-dimensional economic models.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersScalable and Accurate Variational Bayes for High-Dimensional Binary Regression Models

Augusto Fasano, Giacomo Zanella, Daniele Durante

No citations found for this paper.

Comments (0)