Summary

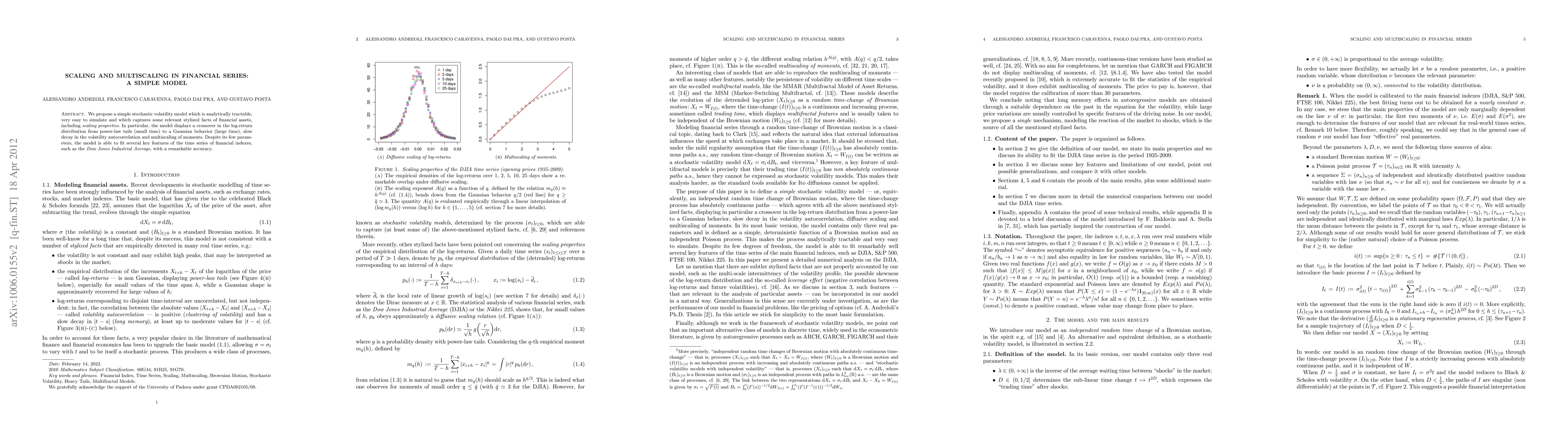

We propose a simple stochastic volatility model which is analytically tractable, very easy to simulate and which captures some relevant stylized facts of financial assets, including scaling properties. In particular, the model displays a crossover in the log-return distribution from power-law tails (small time) to a Gaussian behavior (large time), slow decay in the volatility autocorrelation and multiscaling of moments. Despite its few parameters, the model is able to fit several key features of the time series of financial indexes, such as the Dow Jones Industrial Average, with a remarkable accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)