Summary

In the preceding paper we presented empirical results describing the growth of publicly-traded United States manufacturing firms within the years 1974--1993. Our results suggest that the data can be described by a scaling approach. Here, we propose models that may lead to some insight into these phenomena. First, we study a model in which the growth rate of a company is affected by a tendency to retain an ``optimal'' size. That model leads to an exponential distribution of the logarithm of the growth rate in agreement with the empirical results. Then, we study a hierarchical tree-like model of a company that enables us to relate the two parameters of the model to the exponent $\beta$, which describes the dependence of the standard deviation of the distribution of growth rates on size. We find that $\beta = -\ln \Pi / \ln z$, where $z$ defines the mean branching ratio of the hierarchical tree and $\Pi$ is the probability that the lower levels follow the policy of higher levels in the hierarchy. We also study the distribution of growth rates of this hierarchical model. We find that the distribution is consistent with the exponential form found empirically.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

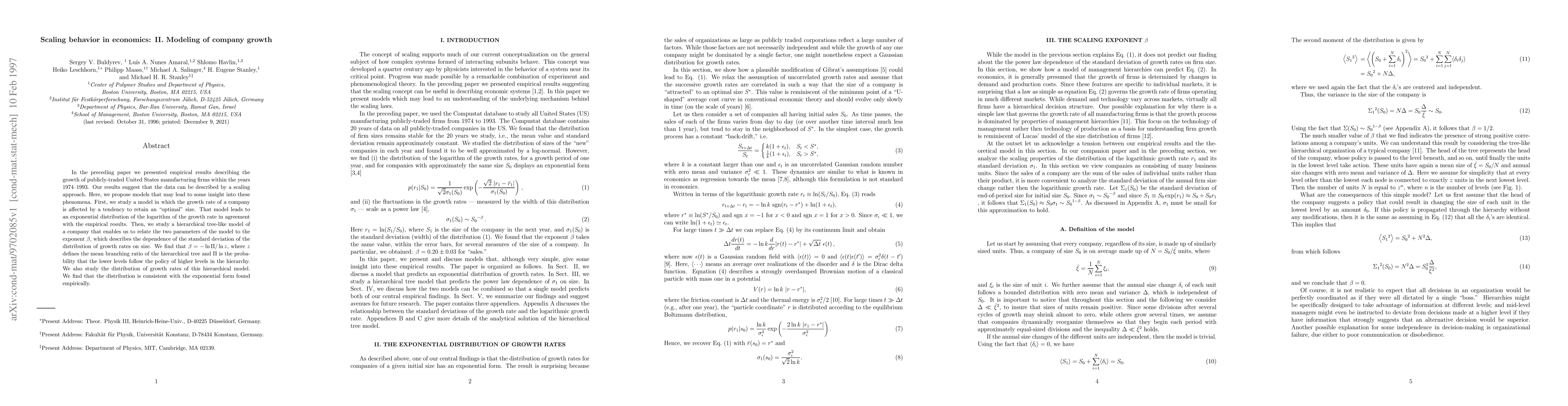

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting Company Growth by Econophysics informed Machine Learning

Jiang Zhang, Ruyi Tao, Kaiwei Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)