Summary

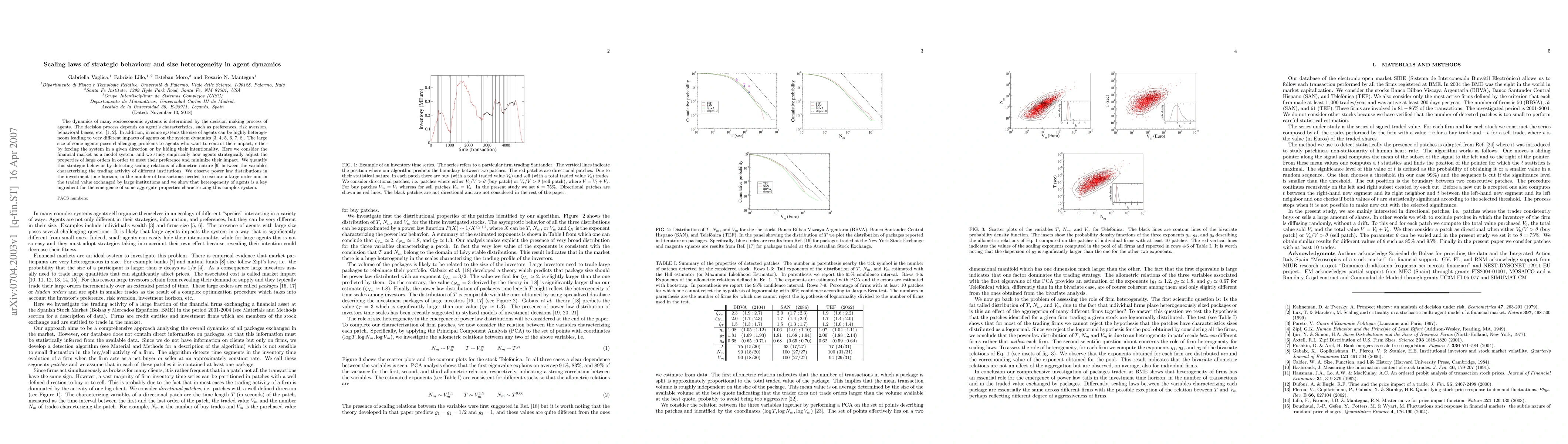

The dynamics of many socioeconomic systems is determined by the decision making process of agents. The decision process depends on agent's characteristics, such as preferences, risk aversion, behavioral biases, etc.. In addition, in some systems the size of agents can be highly heterogeneous leading to very different impacts of agents on the system dynamics. The large size of some agents poses challenging problems to agents who want to control their impact, either by forcing the system in a given direction or by hiding their intentionality. Here we consider the financial market as a model system, and we study empirically how agents strategically adjust the properties of large orders in order to meet their preference and minimize their impact. We quantify this strategic behavior by detecting scaling relations of allometric nature between the variables characterizing the trading activity of different institutions. We observe power law distributions in the investment time horizon, in the number of transactions needed to execute a large order and in the traded value exchanged by large institutions and we show that heterogeneity of agents is a key ingredient for the emergence of some aggregate properties characterizing this complex system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)