Summary

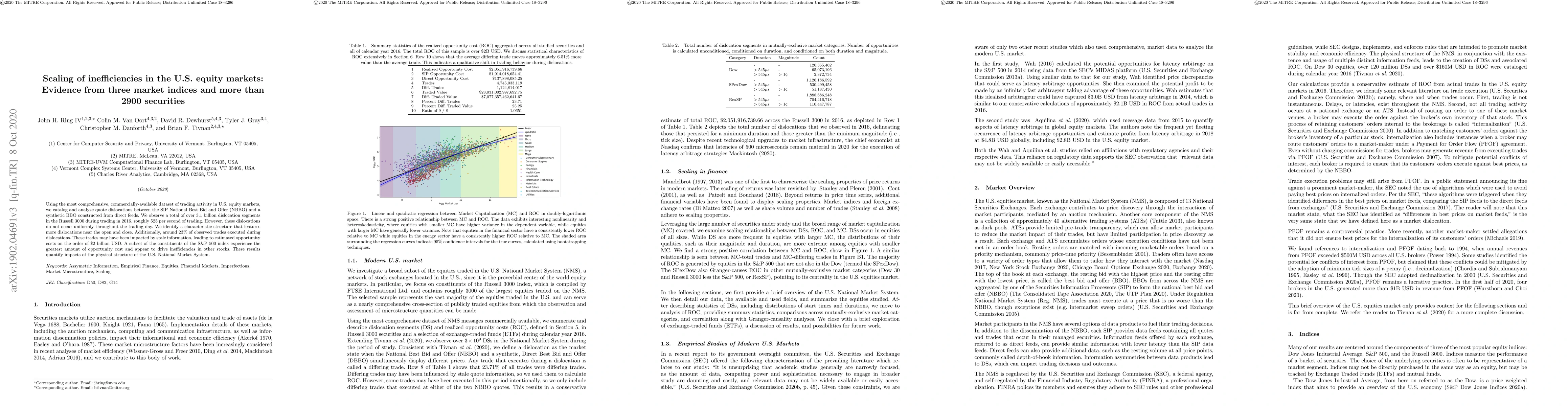

Using the most comprehensive, commercially-available dataset of trading activity in U.S. equity markets, we catalog and analyze quote dislocations between the SIP National Best Bid and Offer (NBBO) and a synthetic BBO constructed from direct feeds. We observe a total of over 3.1 billion dislocation segments in the Russell 3000 during trading in 2016, roughly 525 per second of trading. However, these dislocations do not occur uniformly throughout the trading day. We identify a characteristic structure that features more dislocations near the open and close. Additionally, around 23% of observed trades executed during dislocations. These trades may have been impacted by stale information, leading to estimated opportunity costs on the order of $ 2 billion USD. A subset of the constituents of the S&P 500 index experience the greatest amount of opportunity cost and appear to drive inefficiencies in other stocks. These results quantify impacts of the physical structure of the U.S. National Market System.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamics of the securities market in the information asymmetry context: developing a methodology for emerging securities markets

Kostyantyn Anatolievich Malyshenko, Majid Mohammad Shafiee, Vadim Anatolievich Malyshenko et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)