Summary

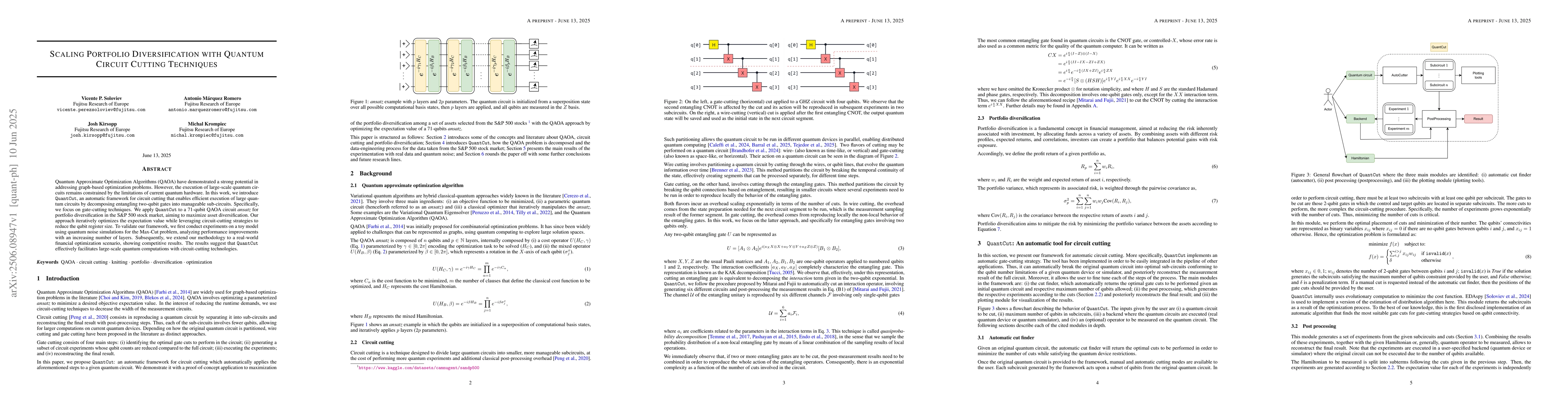

Quantum Approximate Optimization Algorithms (QAOA) have demonstrated a strong potential in addressing graph-based optimization problems. However, the execution of large-scale quantum circuits remains constrained by the limitations of current quantum hardware. In this work, we introduce QuantCut, an automatic framework for circuit cutting that enables efficient execution of large quantum circuits by decomposing entangling two-qubit gates into manageable sub-circuits. Specifically, we focus on gate-cutting techniques. We apply QuantCut to a 71-qubit QAOA circuit ansatz for portfolio diversification in the S&P 500 stock market, aiming to maximize asset diversification. Our approach iteratively optimizes the expectation value while leveraging circuit-cutting strategies to reduce the qubit register size. To validate our framework, we first conduct experiments on a toy model using quantum noise simulations for the Max-Cut problem, analyzing performance improvements with an increasing number of layers. Subsequently, we extend our methodology to a real-world financial optimization scenario, showing competitive results. The results suggest that QuantCut effectively facilitates large-scale quantum computations with circuit-cutting technologies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersUnderstanding the Scalability of Circuit Cutting Techniques for Practical Quantum Applications

Prakash Murali, Songqinghao Yang

Approximate Quantum Circuit Cutting

Qiang Guan, Vipin Chaudhary, Shuai Xu et al.

State Dependent Optimization with Quantum Circuit Cutting

Ji Liu, Paul Hovland, Vipin Chaudhary et al.

No citations found for this paper.

Comments (0)