Summary

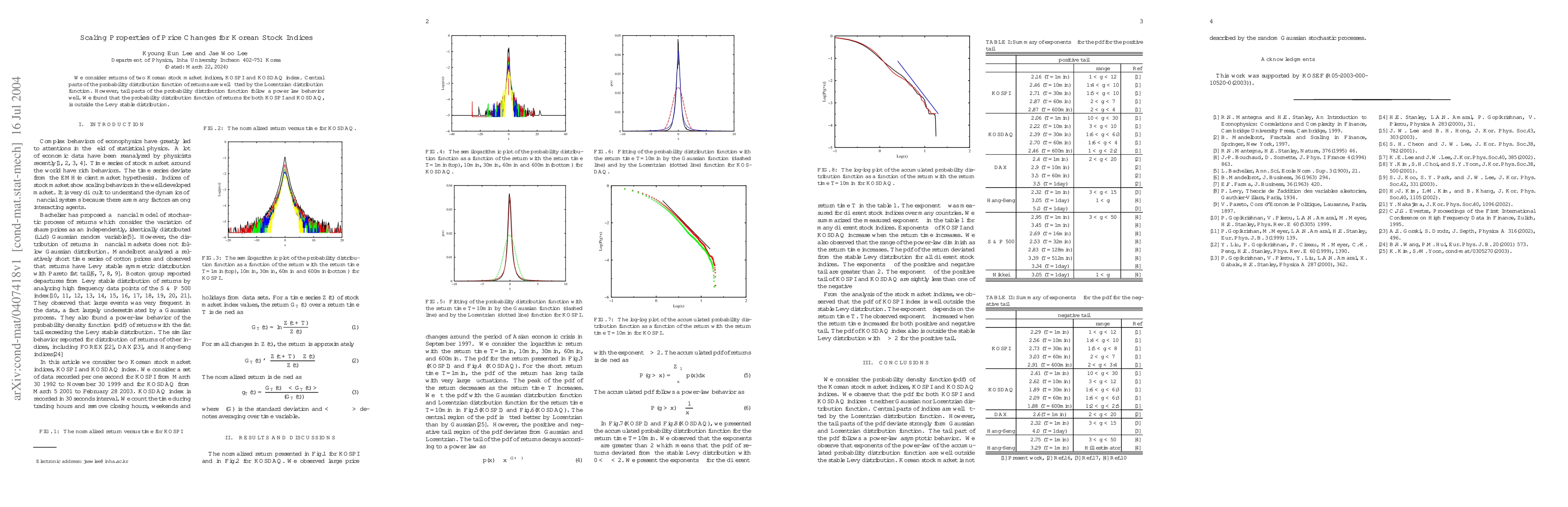

We consider returns of two Korean stock market indices, KOSPI and KOSDAQ index. Central parts of the probability distribution function of returns are well fitted by the Lorentzian distribution function. However, tail parts of the probability distribution function follow a power law behavior well. We found that the probability distribution function of returns for both KOSPI and KOSDAQ, is outside the L\'{e}vy stable distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)