Summary

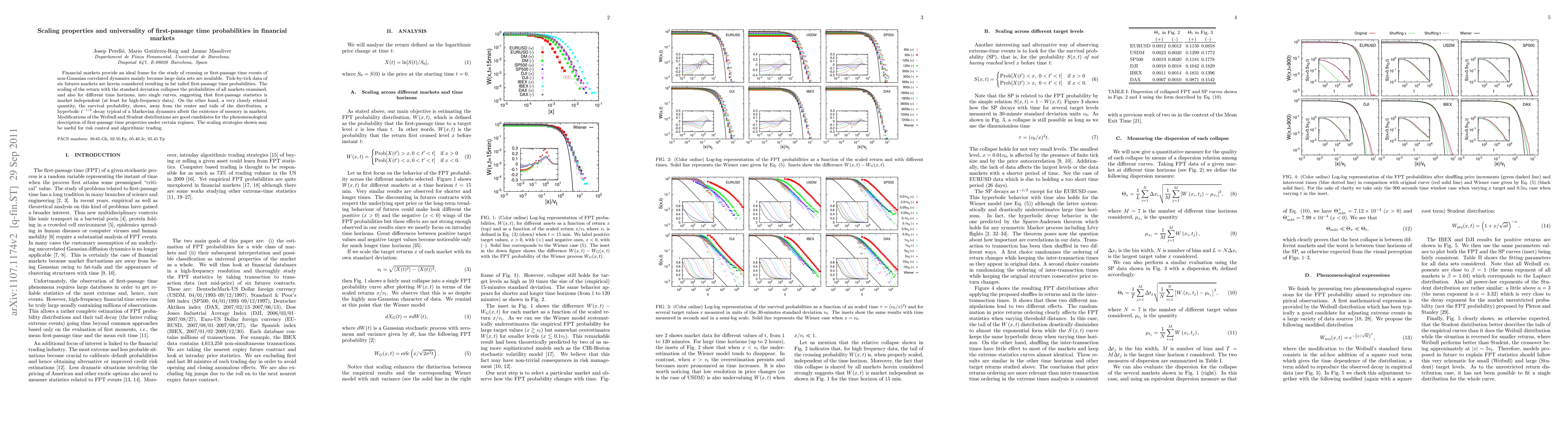

Financial markets provide an ideal frame for the study of crossing or first-passage time events of non-Gaussian correlated dynamics mainly because large data sets are available. Tick-by-tick data of six futures markets are herein considered resulting in fat tailed first-passage time probabilities. The scaling of the return with the standard deviation collapses the probabilities of all markets examined, and also for different time horizons, into single curves, suggesting that first-passage statistics is market independent (at least for high-frequency data). On the other hand, a very closely related quantity, the survival probability, shows, away from the center and tails of the distribution, a hyperbolic $t^{-1/2}$ decay typical of a Markovian dynamics albeit the existence of memory in markets. Modifications of the Weibull and Student distributions are good candidates for the phenomenological description of first-passage time properties under certain regimes. The scaling strategies shown may be useful for risk control and algorithmic trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)