Authors

Summary

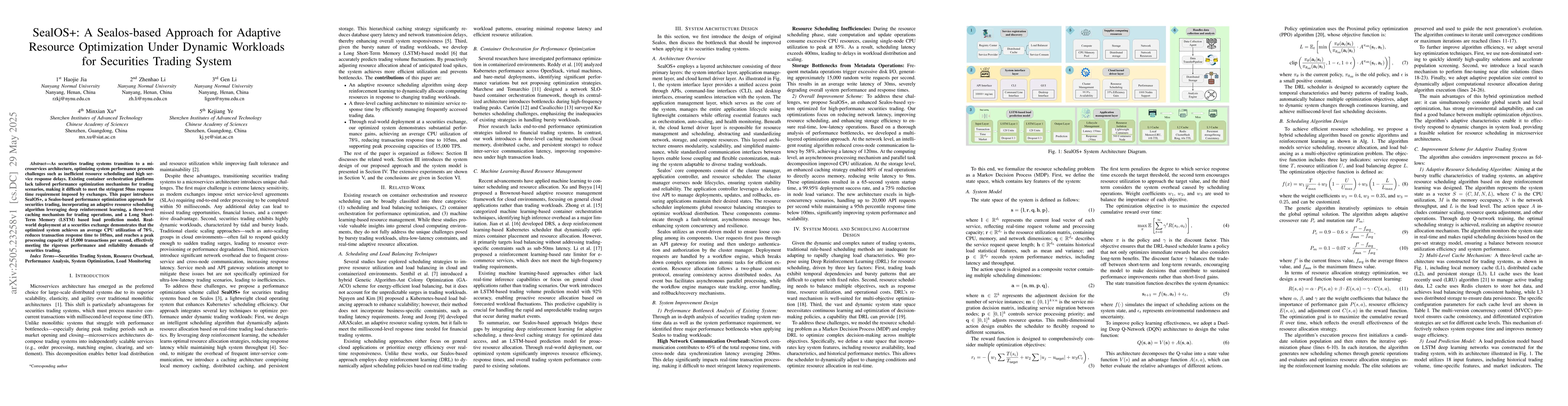

As securities trading systems transition to a microservices architecture, optimizing system performance presents challenges such as inefficient resource scheduling and high service response delays. Existing container orchestration platforms lack tailored performance optimization mechanisms for trading scenarios, making it difficult to meet the stringent 50ms response time requirement imposed by exchanges. This paper introduces SealOS+, a Sealos-based performance optimization approach for securities trading, incorporating an adaptive resource scheduling algorithm leveraging deep reinforcement learning, a three-level caching mechanism for trading operations, and a Long Short-Term Memory (LSTM) based load prediction model. Real-world deployment at a securities exchange demonstrates that the optimized system achieves an average CPU utilization of 78\%, reduces transaction response time to 105ms, and reaches a peak processing capacity of 15,000 transactions per second, effectively meeting the rigorous performance and reliability demands of securities trading.

AI Key Findings

Generated Jun 06, 2025

Methodology

The paper introduces SealOS+, a Sealos-based approach for securities trading optimization, incorporating adaptive resource scheduling via deep reinforcement learning, a three-level caching mechanism, and an LSTM-based load prediction model.

Key Results

- SealOS+ achieves an average CPU utilization of 78%.

- Transaction response time is reduced to 105ms.

- The system reaches a peak processing capacity of 15,000 transactions per second.

- Meets the stringent 50ms response time requirement imposed by exchanges.

Significance

This research is significant as it addresses the performance optimization challenges in microservices-based securities trading systems, which are crucial for high-frequency trading environments.

Technical Contribution

SealOS+ presents an adaptive resource scheduling algorithm, a three-level caching mechanism, and an LSTM-based load prediction model tailored for securities trading systems.

Novelty

SealOS+ differentiates itself by focusing specifically on securities trading systems, integrating deep reinforcement learning for resource optimization, and employing LSTM for load prediction, addressing a gap in existing container orchestration platforms.

Limitations

- The paper does not discuss scalability beyond the demonstrated 15,000 tps.

- Potential limitations of reinforcement learning in dynamic, unpredictable trading scenarios are not explored.

Future Work

- Investigate scalability improvements for handling even higher transaction volumes.

- Explore advanced reinforcement learning techniques to better handle unpredictable trading dynamics.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCluster Resource Management for Dynamic Workloads by Online Optimization

George Kesidis, Nader Alfares, Ata Fatahi Baarzi et al.

Resource Optimization with MPI Process Malleability for Dynamic Workloads in HPC Clusters

Antonio J. Peña, Sergio Iserte, Iker Martín-Álvarez et al.

EdgeMLBalancer: A Self-Adaptive Approach for Dynamic Model Switching on Resource-Constrained Edge Devices

Karthik Vaidhyanathan, Akhila Matathammal, Kriti Gupta et al.

No citations found for this paper.

Comments (0)