Summary

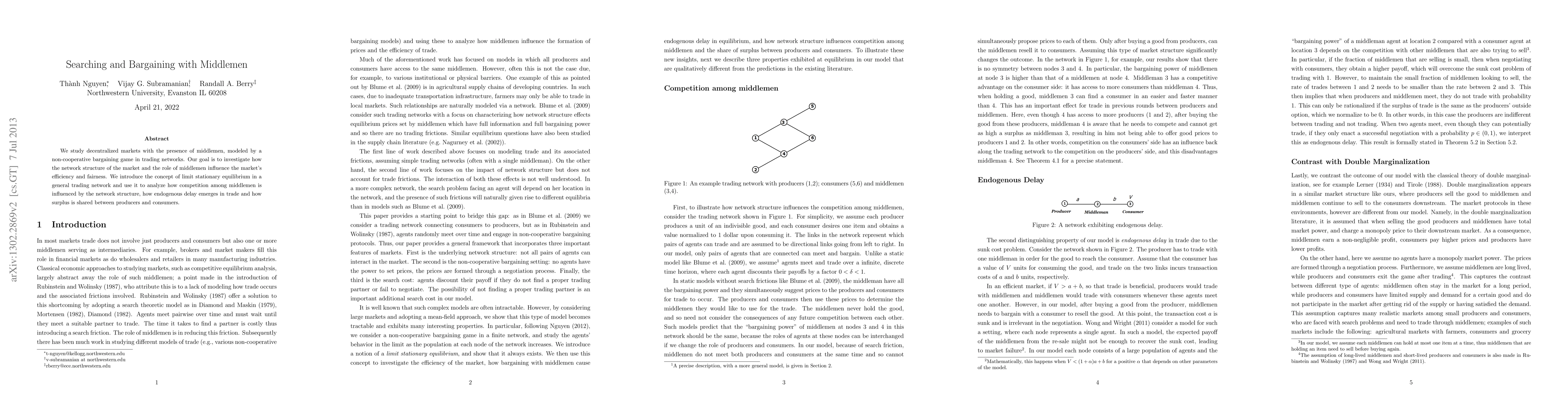

We study decentralized markets with the presence of middlemen, modeled by a non-cooperative bargaining game in trading networks. Our goal is to investigate how the network structure of the market and the role of middlemen influence the market's efficiency and fairness. We introduce the concept of limit stationary equilibrium in a general trading network and use it to analyze how competition among middlemen is influenced by the network structure, how endogenous delay emerges in trade and how surplus is shared between producers and consumers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)