Summary

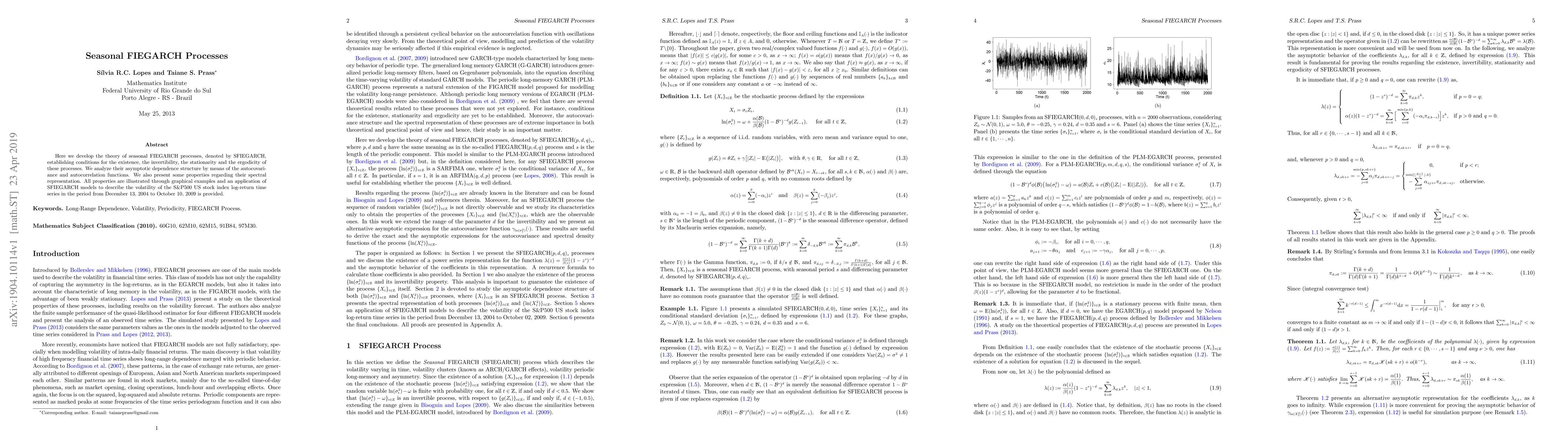

Here we develop the theory of seasonal FIEGARCH processes, denoted by SFIEGARCH, establishing conditions for the existence, the invertibility, the stationarity and the ergodicity of these processes. We analyze their asymptotic dependence structure by means of the autocovariance and autocorrelation functions. We also present some properties regarding their spectral representation. All properties are illustrated through graphical examples and an application of SFIEGARCH models to describe the volatility of the S&P500 US stock index log-return time series in the period from December 13, 2004 to October 10, 2009 is provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)