Summary

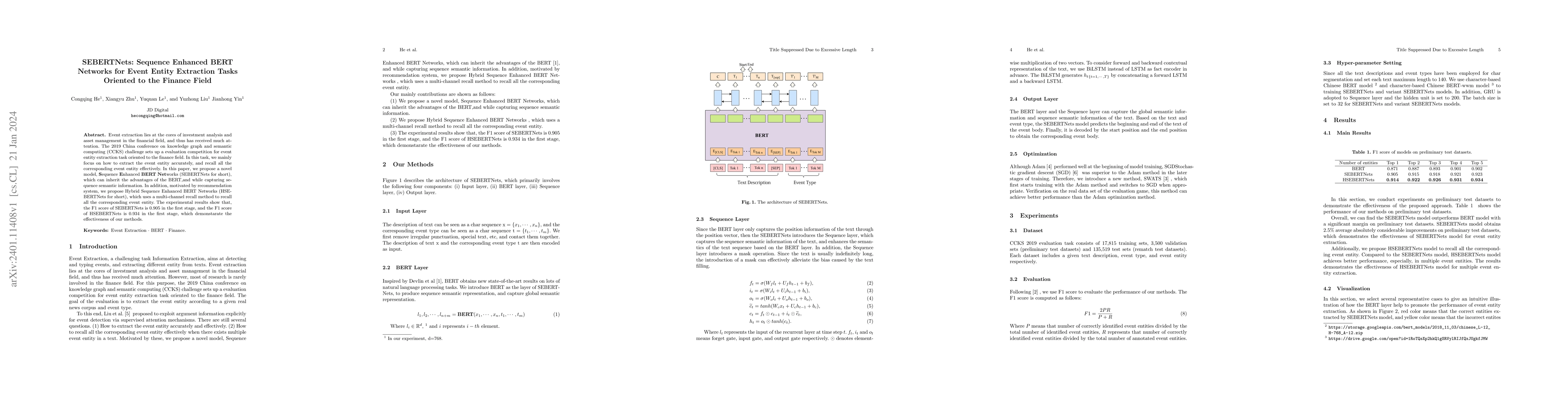

Event extraction lies at the cores of investment analysis and asset management in the financial field, and thus has received much attention. The 2019 China conference on knowledge graph and semantic computing (CCKS) challenge sets up a evaluation competition for event entity extraction task oriented to the finance field. In this task, we mainly focus on how to extract the event entity accurately, and recall all the corresponding event entity effectively. In this paper, we propose a novel model, Sequence Enhanced BERT Networks (SEBERTNets for short), which can inherit the advantages of the BERT,and while capturing sequence semantic information. In addition, motivated by recommendation system, we propose Hybrid Sequence Enhanced BERT Networks (HSEBERTNets for short), which uses a multi-channel recall method to recall all the corresponding event entity. The experimental results show that, the F1 score of SEBERTNets is 0.905 in the first stage, and the F1 score of HSEBERTNets is 0.934 in the first stage, which demonstarate the effectiveness of our methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHarnessing Generative LLMs for Enhanced Financial Event Entity Extraction Performance

Ji-jun Park, Soo-joon Choi

Lexicon Enhanced Chinese Sequence Labeling Using BERT Adapter

Yue Zhang, Wei Liu, Xiyan Fu et al.

No citations found for this paper.

Comments (0)