Summary

The aim of this paper is twofold. First, we extend the results of [33] concerning the existence and uniqueness of second-order reflected 2BSDEs to the case of two obstacles. Under some regularity assumptions on one of the barriers, similar to the ones in [10], and when the two barriers are completely separated, we provide a complete wellposedness theory for doubly reflected second-order BSDEs. We also show that these objects are related to non-standard optimal stopping games, thus generalizing the connection between DRBSDEs and Dynkin games first proved by Cvitanic and Karatzas [11]. More precisely, we show under a technical assumption that the second order DRBSDEs provide solutions of what we call uncertain Dynkin games and that they also allow us to obtain super and subhedging prices for American game options (also called Israeli options) in financial markets with volatility uncertainty

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

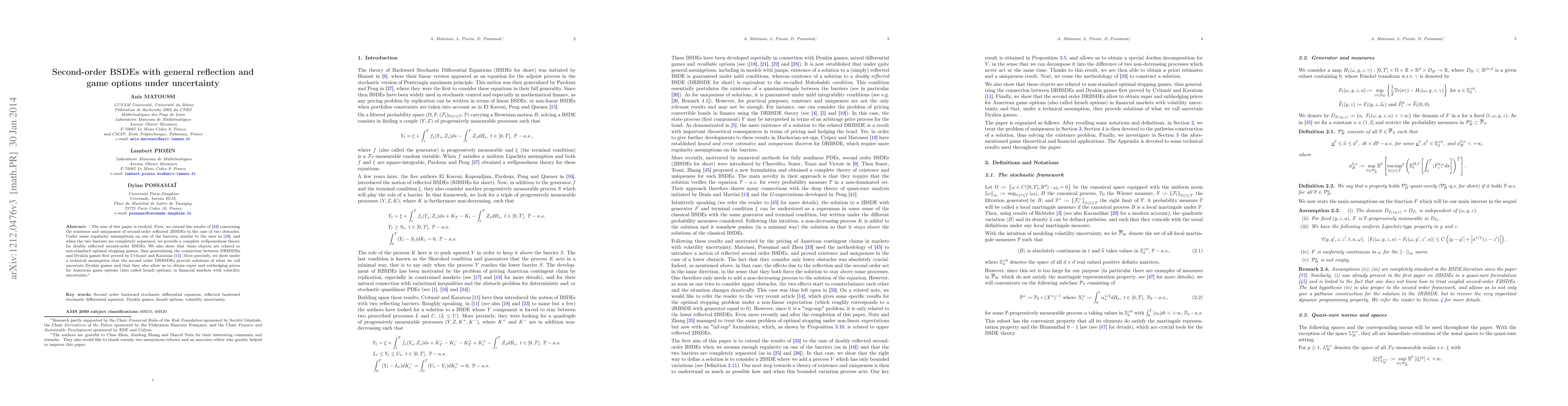

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)