Summary

Uncovering the risk transmitting path within economic sectors in China is crucial for understanding the stability of the Chinese economic system, especially under the current situation of the China-US trade conflicts. In this paper, we try to uncover the risk spreading channels by means of volatility spillovers within the Chinese sectors using stock market data. By applying the generalized variance decomposition framework based on the VAR model and the rolling window approach, a set of connectedness matrices is obtained to reveal the overall and dynamic spillovers within sectors. It is found that 17 sectors (mechanical equipment, electrical equipment, utilities, and so on) are risk transmitters and 11 sectors (national defence, bank, non-bank finance, and so on) are risk takers during the whole period. During the periods with the extreme risk events (the global financial crisis, the Chinese interbank liquidity crisis, the Chinese stock market plunge, and the China-US trade war), we observe that the connectedness measures significantly increase and the financial sectors play a buffer role in stabilizing the economic system. The robust tests suggest that our results are not sensitive to the changes of model parameters. Our results not only uncover the spillover effects within the Chinese sectors, but also highlight the deep understanding of the risk contagion patterns in the Chinese stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

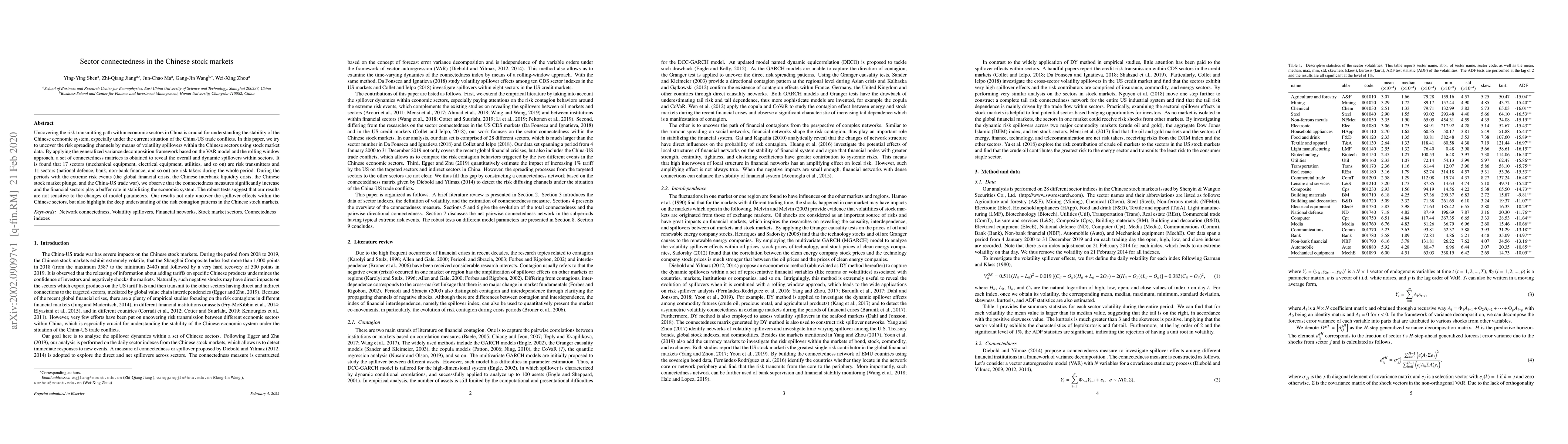

| Title | Authors | Year | Actions |

|---|

Comments (0)