Summary

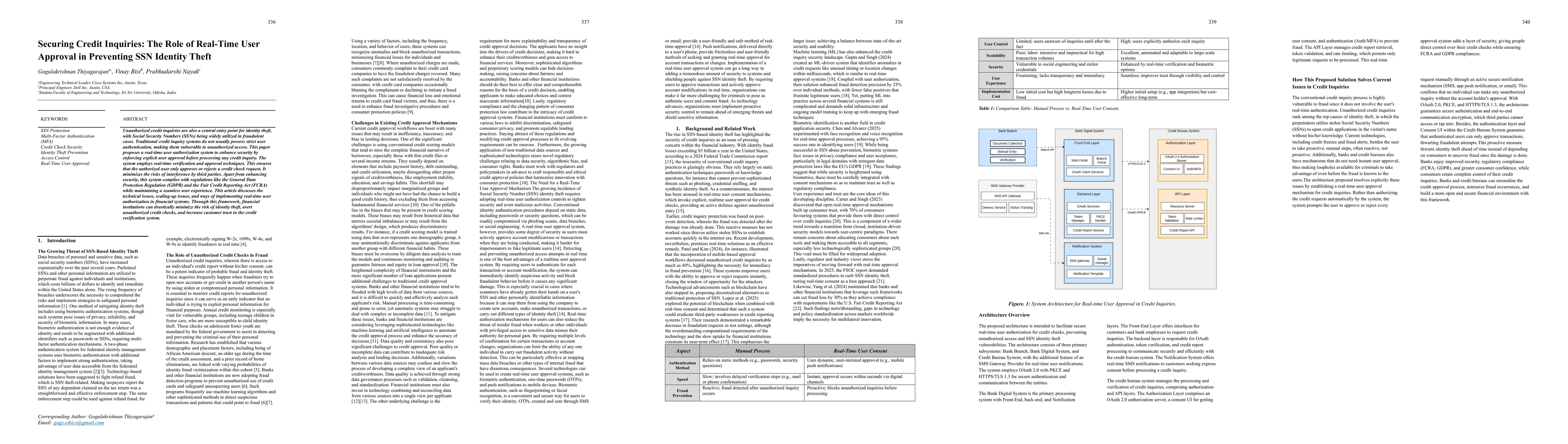

Unauthorized credit inquiries are also a central entry point for identity theft, with Social Security Numbers (SSNs) being widely utilized in fraudulent cases. Traditional credit inquiry systems do not usually possess strict user authentication, making them vulnerable to unauthorized access. This paper proposes a real-time user authorization system to enhance security by enforcing explicit user approval before processing any credit inquiry. The system employs real-time verification and approval techniques. This ensures that the authorized user only approves or rejects a credit check request. It minimizes the risks of interference by third parties. Apart from enhancing security, this system complies with regulations like the General Data Protection Regulation (GDPR) and the Fair Credit Reporting Act (FCRA) while maintaining a seamless user experience. This article discusses the technical issues, scaling-up issues, and ways of implementing real-time user authorization in financial systems. Through this framework, financial institutions can drastically minimize the risk of identity theft, avert unauthorized credit checks, and increase customer trust in the credit verification system.

AI Key Findings

Generated Jun 07, 2025

Methodology

The paper discusses technical issues, scaling-up issues, and implementation methods for real-time user authorization in financial systems.

Key Results

- Proposes a real-time user authorization system to secure credit inquiries.

- Minimizes risks of unauthorized credit checks and identity theft.

Significance

This research is important for enhancing security in financial systems, complying with regulations like GDPR and FCRA, and increasing customer trust.

Technical Contribution

The main technical contribution is the design and proposal of a real-time user authorization system for credit inquiries.

Novelty

This work is novel by focusing on real-time user approval to prevent SSN identity theft, addressing a gap in traditional credit inquiry systems' security.

Limitations

- The paper does not detail long-term performance or cost-effectiveness of the proposed system.

- Potential impact on user experience during real-time authorization is not extensively discussed.

Future Work

- Explore long-term performance and cost-effectiveness of the proposed system.

- Investigate further improvements to user experience in real-time authorization processes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Integrated Machine Learning and Deep Learning Framework for Credit Card Approval Prediction

Yijing Wei, Yanxin Shen, Yujian Long et al.

No citations found for this paper.

Comments (0)