Summary

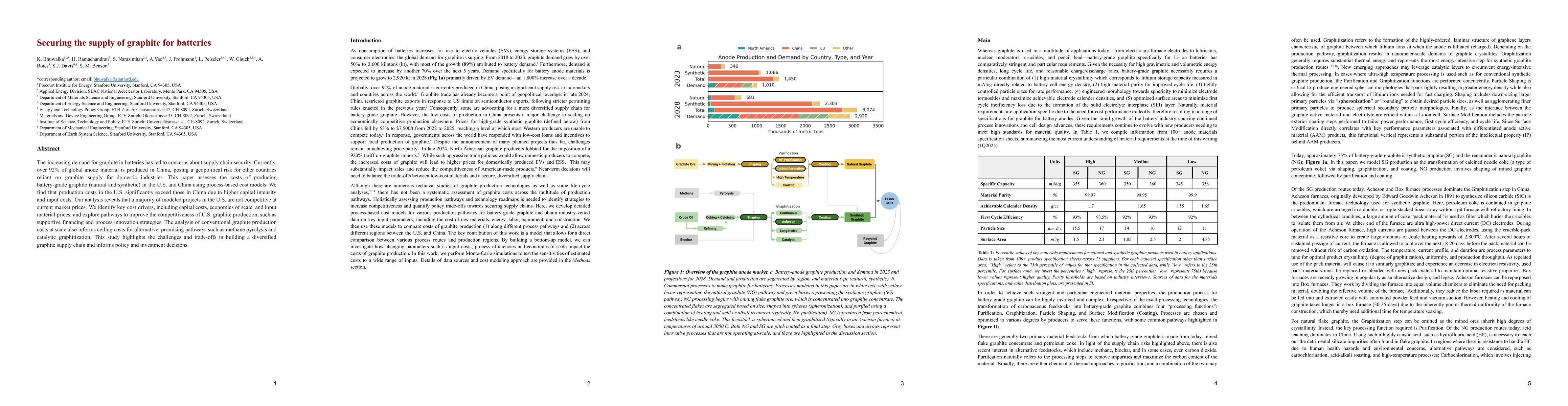

The increasing demand for graphite in batteries has led to concerns around supply chain security. Currently, over 92% of global anode material is produced in China, posing a geopolitical risk for other countries reliant on graphite supply for domestic industries. This paper assesses the costs of producing battery-grade graphite (natural and synthetic) in the US and China using process-based cost models. We find that production costs in the US significantly exceed those in China due to higher capital intensity and input costs. Our analysis reveals that a majority of modeled projects in the US are not competitive at current market prices. We identify key cost drivers, including capital costs, economies of scale, and input material prices, and explore pathways to improve the competitiveness of US graphite production, such as supportive financing and process innovation directions. The analysis of conventional graphite production costs at scale also informs ceiling costs for alternative, promising pathways such as methane pyrolysis and catalytic graphitization. This study highlights the challenges and trade-offs in building a diversified graphite supply chain and informs policy and investment decisions.

AI Key Findings

Generated Jun 10, 2025

Methodology

A process-based cost model was developed to estimate the techno-economics of common graphite production pathways, comparing costs of AAM produced in the U.S. and China. The model identifies key parameters driving costs through a Monte Carlo simulation.

Key Results

- US graphite production costs significantly exceed China's due to higher capital intensity and input costs.

- A majority of modeled US projects are not competitive at current market prices.

- Key cost drivers include capital costs, economies of scale, and input material prices.

- Supportive financing and process innovation can improve US graphite production competitiveness.

- Conventional graphite production costs inform ceiling costs for alternative pathways like methane pyrolysis and catalytic graphitization.

Significance

This research highlights challenges in building a diversified graphite supply chain, informing policy and investment decisions amidst geopolitical risks associated with China's dominance in graphite production.

Technical Contribution

The development of a generalized process-based cost model for estimating techno-economics of graphite production pathways, enabling like-for-like comparisons between regions and processing routes.

Novelty

This research provides a comprehensive analysis of the cost drivers in graphite production, identifying specific areas for improvement and informing policy decisions to support the development of a secure and diversified graphite supply chain.

Limitations

- The study focuses on current production methods and does not extensively explore emerging technologies.

- Model assumptions and input data may not capture all real-world complexities.

Future Work

- Apply the approach to study the competitiveness of new processing pathways, such as methane pyrolysis and catalytic graphitization.

- Model the impacts of supply disruptions to quantify the value of building a resilient supply chain.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCapturing Opportunity Costs of Batteries with a Staircase Supply-Demand Function

Cong Chen, Ye Guo, Chenge Gao

Study of In-plane and Interlayer Interactions During Aluminum Fluoride Intercalation in Graphite: Implications for the Development of Rechargeable Batteries

Sindy J. Rodríguez, Adriana E. Candia, Igor Stanković et al.

No citations found for this paper.

Comments (0)