Summary

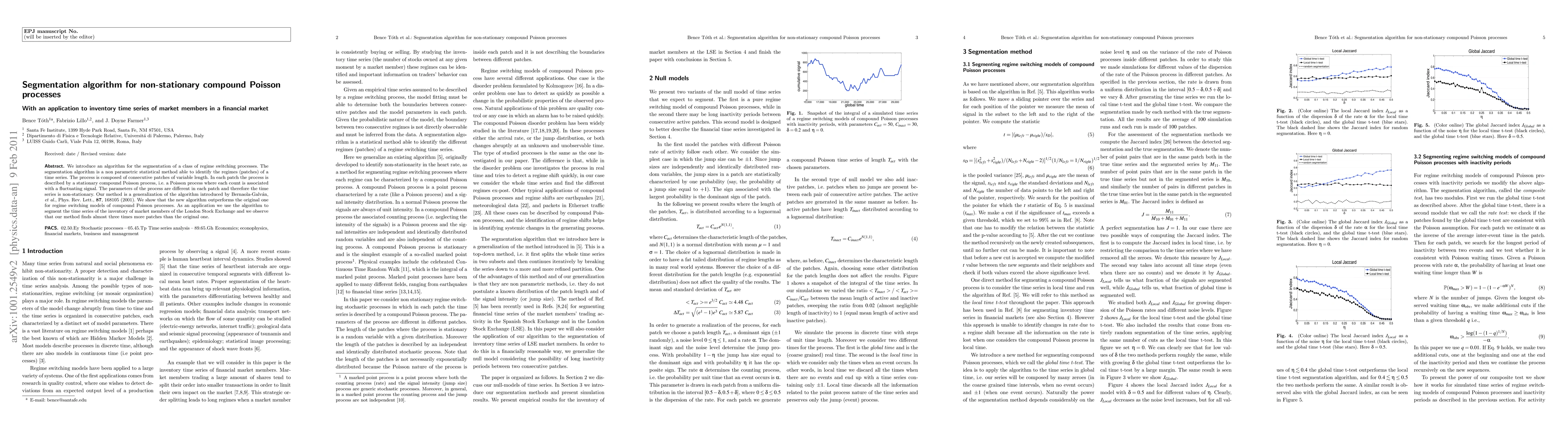

We introduce an algorithm for the segmentation of a class of regime switching processes. The segmentation algorithm is a non parametric statistical method able to identify the regimes (patches) of the time series. The process is composed of consecutive patches of variable length, each patch being described by a stationary compound Poisson process, i.e. a Poisson process where each count is associated to a fluctuating signal. The parameters of the process are different in each patch and therefore the time series is non stationary. Our method is a generalization of the algorithm introduced by Bernaola-Galvan, et al., Phys. Rev. Lett., 87, 168105 (2001). We show that the new algorithm outperforms the original one for regime switching compound Poisson processes. As an application we use the algorithm to segment the time series of the inventory of market members of the London Stock Exchange and we observe that our method finds almost three times more patches than the original one.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNon-central moderate deviations for compound fractional Poisson processes

Claudio Macci, Luisa Beghin

| Title | Authors | Year | Actions |

|---|

Comments (0)